Get Il Schedule K-1-p 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Schedule K-1-P online

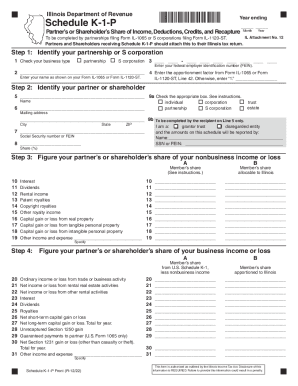

The IL Schedule K-1-P is an important document for partnerships and S corporations in Illinois, providing a detailed report of each partner's or shareholder's income, deductions, credits, and recapture. This guide will assist users in accurately filling out this form online, ensuring that all required information is collected clearly and efficiently.

Follow the steps to complete the IL Schedule K-1-P online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify your partnership or S corporation by checking the appropriate business type box and entering the federal employer identification number (FEIN) as well as the name as shown on the relevant tax form.

- Identify your partner or shareholder by providing their name, mailing address, and social security number or FEIN. Include the share percentage allotted to them.

- Figure your partner's or shareholder's share of nonbusiness income or loss by detailing the amounts for categories such as interest, dividends, and rental income.

- Calculate your partner's or shareholder's share of business income or loss by completing the relevant fields for ordinary income, net income or loss, and other reported amounts.

- Determine your partner's or shareholder's share of Illinois additions and subtractions by following the instructions to report amounts listed in columns A and B.

- Finally, figure your partner's or shareholder's share of Illinois credits, recapture, and applicable taxes by specifying the relevant credit amounts and any pass-through withholding.

- Once you have completed all fields, review the information for accuracy. You can then save changes, download, print, or share the completed form as needed.

Begin filling out your IL Schedule K-1-P online to ensure accurate reporting of all required information.

The Schedule K-1 form helps report income, deductions, and credits from partnerships and S corporations. It provides detailed information that is necessary for individuals to compile their tax returns. Properly completing your IL Schedule K-1-P allows you to take advantage of specific tax benefits based on your participation in the business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.