Loading

Get De Form Ira 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE Form IRA online

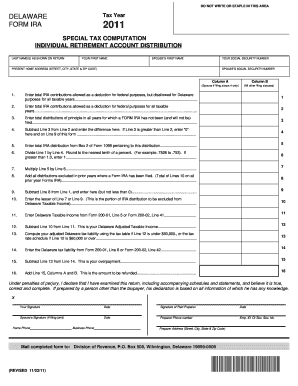

Filling out the DE Form IRA online can streamline your tax filing process, helping you manage your individual retirement account distributions accurately. This guide provides step-by-step instructions to ensure you complete the form correctly, enhancing your filing experience.

Follow the steps to fill out the DE Form IRA online.

- Press the ‘Get Form’ button to access the DE Form IRA and open it for editing.

- Begin by providing your last name and first name as it appears on your tax return. Additionally, ensure to include your spouse’s first name if applicable.

- Enter your social security number and your spouse’s social security number if filing jointly.

- Fill in your present home address, including street, city, state, and ZIP code.

- In Column A, input the total IRA contributions allowed as a deduction for federal purposes but disallowed for Delaware purposes (Line 1).

- Next, enter the total IRA contributions allowed as a deduction for federal purposes for all taxable years (Line 2).

- Complete Line 3 by entering the total distributions of principle in all years for which a Form IRA has not been filed.

- Subtract Line 3 from Line 2 and input the result on Line 4. If Line 3 exceeds Line 2, enter '0' on Line 4.

- On Line 5, enter the total IRA distribution from Box 2 of Form 1099 pertaining to this distribution.

- Calculate Line 6 by dividing Line 1 by Line 4, rounding to the nearest tenth of a percent. If the result exceeds 1.0, enter 1.

- Multiply the amount from Line 5 by the result from Line 6 to find your figure for Line 7.

- For Line 8, add all distributions excluded in previous years where a Form IRA has been filed.

- Subtract Line 8 from Line 1 for Line 9, ensuring the result is not less than zero.

- On Line 10, enter the lesser amount from Line 7 or Line 9, which represents the portion of IRA distribution to exclude from Delaware taxable income.

- Input your Delaware taxable income from the appropriate line on Form 200-01 or Form 200-02 on Line 11.

- Compute your Delaware adjusted taxable income by subtracting Line 10 from Line 11 (Line 12).

- Determine your adjusted Delaware tax liability using the correct tax table based on the amount from Line 12.

- Enter your Delaware tax liability from the relevant line on Form 200-01 or Form 200-02 on Line 14.

- Calculate your overpayment by subtracting Line 13 from Line 14, which you will enter on Line 15.

- Add the overpayments from Lines 15 in both Column A and Column B for your refund amount, which goes on Line 16.

- Finally, review the declaration statement, providing your signature, date, and any additional required signatures before submitting the form.

- Once completed, save your changes, download, print, or share the form as needed.

Start filling out the DE Form IRA online to ensure you manage your individual retirement account correctly.

Filling out a distribution request form typically involves providing your personal information, account details, and the specific amount you wish to withdraw. Make sure to review any tax implications linked to the withdrawal. Resources like the DE Form IRA can provide templates and examples to assist you in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.