Get Purdue University Substitute W-9 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Purdue University Substitute W-9 online

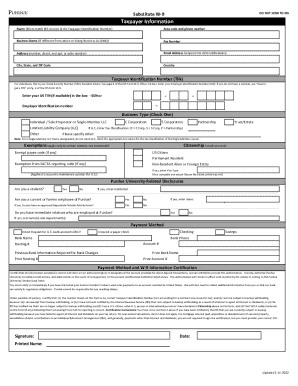

The Purdue University Substitute W-9 form is an important document used for tax purposes. This guide will provide you with step-by-step instructions on how to complete the form online, ensuring that all necessary information is accurately filled out.

Follow the steps to complete the Purdue University Substitute W-9 online

- Press the ‘Get Form’ button to access the Purdue University Substitute W-9 form and open it using your preferred digital editor.

- In the Taxpayer Information section, enter your legal name as it aligns with IRS records, along with your area code and phone number.

- If applicable, provide your business name or Doing Business As (DBA) in the designated field, followed by your fax number.

- Fill in your complete address, including the number, street, and apartment or suite number, along with your city, state, and ZIP code.

- Provide your country of residence and your Taxpayer Identification Number (TIN). Enter your Social Security Number (SSN) if you are an individual or your Employer Identification Number (EIN) if you represent an entity.

- Select your business type by checking the appropriate box. If you are registering as a Limited Liability Company (LLC), enter the tax classification if you are a Single-Member LLC.

- Indicate any exemptions that may apply to you or your entity, and check the box that confirms your citizenship status.

- Respond to the Purdue University-related disclosures, indicating your relationship with the university, whether you are a student or employee, and provide any additional requested information.

- Choose your preferred payment method, specifying if you desire direct deposit or a paper check, and provide the necessary bank account details.

- Complete the payment method and W-9 information certification by ensuring the accuracy of the information provided and signing the form with your printed name and date.

- Finally, save your changes, and use the options to download, print, or share the completed form as needed.

Complete your Purdue University Substitute W-9 online today to ensure timely processing of your tax-related documents.

Forms similar to a W-9 include the Form W-8 series, which is used by foreign individuals or entities to certify their foreign status and claim tax treaty benefits. Additionally, independent contractors may sometimes use Form 1099 for reporting income, but the W-9 is crucial for entities like Purdue University to validate taxpayer information. Understanding these forms can help facilitate accurate tax reporting when dealing with Purdue University.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.