Loading

Get Sc Sc1120-t 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC1120-T online

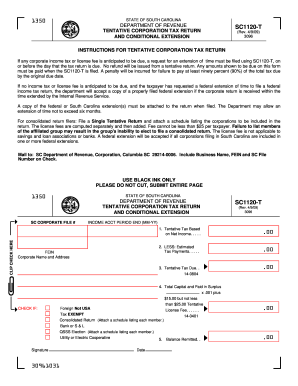

The SC SC1120-T is the tentative corporation tax return and conditional extension form for the state of South Carolina. This guide will provide you with clear instructions on how to effectively complete this form online, ensuring you meet your tax obligations accurately and efficiently.

Follow the steps to complete the SC SC1120-T online.

- Press the ‘Get Form’ button to access the SC SC1120-T and open it in your preferred form editor.

- Enter the income account period end date in the format MM-YY at the top of the form.

- Provide your Federal Employer Identification Number (FEIN) in the appropriate field.

- Fill in the corporate name and mailing address, making sure all information is accurate and complete.

- In Section 1, calculate your tentative tax based on net income and enter the total amount.

- In Section 2, subtract any estimated tax payments made and enter the resulting figure.

- In Section 3, determine the tentative tax due by answering the calculations from the previous sections.

- In Section 4, calculate the total capital and paid-in surplus, applying the necessary calculations to determine the tentative license fee. Check the relevant options if applicable.

- Complete any additional information needed based on specific business types indicated in the form.

- Sign and date the form at the bottom to certify all submitted information is accurate.

- Review the completed form thoroughly for any errors or omissions.

- Save the changes made, and then download, print, or share the SC SC1120-T form as needed.

Ensure timely and accurate submission of your SC SC1120-T by completing your documents online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.