Get 1 Interest Expense On Investment Debts Paid Or Accrued In 2004 - Revenue Alabama

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Interest Expense On Investment Debts Paid Or Accrued In 2004 - Revenue Alabama online

Filing the 1 Interest Expense On Investment Debts Paid Or Accrued In 2004 - Revenue Alabama form can seem daunting, but with clear guidance, it becomes a manageable task. This guide will provide a step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out your form online.

- Begin by pressing the ‘Get Form’ button to access the form. This will open the document, allowing you to start filling it out.

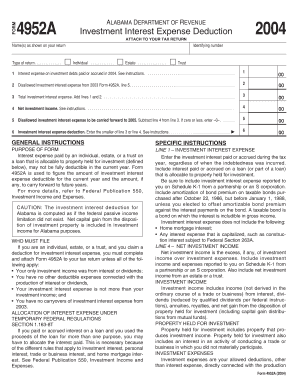

- Fill in your name(s) as displayed on your tax return in the designated field. Ensure that it matches your official documents to avoid any discrepancies.

- Select the type of return you are filing from the provided options. This includes individual, estate, or trust.

- Locate Line 1, where you will enter the investment interest expense paid or accrued during 2004. This includes any interest from loans that relate to property held for investment.

- Proceed to Line 2 to include any disallowed investment interest expense carried over from the previous year, if applicable.

- In Line 3, calculate the total investment interest expense by adding the amounts from Lines 1 and 2. Ensure accuracy in your computations.

- Complete Line 4 by entering your net investment income. This is the income derived from your investments minus any relevant expenses.

- For Line 5, subtract Line 4 from Line 3 to determine the disallowed investment interest expense to be carried forward to the next year. If the result is zero or less, enter '0'.

- Finally, complete Line 6 by entering the smaller amount between Line 3 or Line 4, which represents your allowable investment interest expense deduction for the current year.

- After verifying all entries, you can save your changes, download the completed form, print it, or share it as needed.

Complete your forms online today to ensure timely and accurate filing of your tax documents.

An investment is generally not classified as an expense; rather, it represents an asset intended to generate income over time. However, some costs associated with acquiring an investment, such as fees or interest, may be classified as expenses and are deductible. Understanding the distinction between investments and expenses is crucial for accurate financial reporting and tax filings. Consulting with financial advisors can clarify these types of transactions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.