Loading

Get Exceeded $1000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exceeded $1000 online

This guide provides comprehensive steps for filling out the Exceeded $1000 form online. It aims to ensure that users can efficiently and accurately complete the document while understanding each section and field.

Follow the steps to complete the Exceeded $1000 form online.

- Press the 'Get Form' button to download the Exceeded $1000 form, which you can then open in your chosen editor.

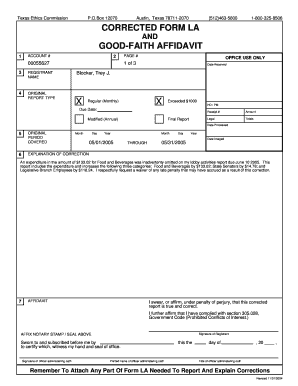

- Begin by entering your account number in the designated field. This is crucial for tracking and managing your report.

- Next, provide your name in the registrant section. Ensure that the name matches the details registered with the ethics commission.

- Indicate the type of report you are submitting, which can include regular or modified reports. Select the appropriate option by marking the corresponding checkbox.

- Fill in the original period covered by your report by entering the start and end dates. Make sure the dates reflect the specific time frame of your expenditures.

- In the explanation of correction section, clearly explain any changes made to your report. This is important for transparency and compliance.

- Affix your signature in the affidavit section. This validates your report and confirms compliance with relevant legislation.

- Finally, review all entries for accuracy. After ensuring that all the required fields are completed, you can save changes, download, print, or share the form as needed.

Complete your Exceeded $1000 document online today for a streamlined filing experience.

Earning $1,000 from YouTube is possible but requires quality content and a dedicated audience. Focus on developing engaging videos that attract viewers and encourage subscriptions. Monetization strategies, such as ads and sponsorships, can also contribute to exceeding $1,000. Be patient, as building a successful channel takes time and effort.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.