Get Chapter Ot 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chapter OT 3 online

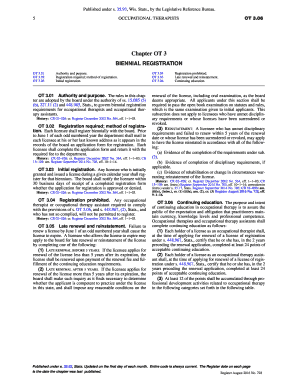

Filling out the Chapter OT 3 form online is a crucial step for occupational therapists and occupational therapy assistants to maintain their registration and comply with state regulations. This guide provides clear, step-by-step instructions to assist users in completing the form accurately.

Follow the steps to successfully complete your registration

- Click the 'Get Form' button to download the Chapter OT 3 form and open it in your preferred online editor.

- Begin filling out your personal details in the designated fields, including your name, address, and license number. Ensure that your information matches the records held by the board.

- In the registration section, select your status as either an occupational therapist or an occupational therapy assistant. Include any additional information requested about your practice setting.

- Complete the section regarding continuing education by certifying that you have completed the required points within the past two years. Provide details of courses or activities that qualify.

- Review any compliance questions that may apply to your professional conduct or past licensing issues and provide truthful responses.

- Attach the required registration fee payment method as directed. Ensure that all information is complete and adheres to any specified requirements.

- Once all fields are completed, save the changes to your form. You may choose to download a copy, print it for your records, or share it with relevant parties as needed.

Begin your online registration process and ensure your compliance with state regulations today!

Filling in a W-8BEN involves providing your name, country of citizenship, and details about your income and the reason for claiming the tax treaty benefit. You must also ensure that the information aligns with the requirements set under Chapter OT 3. For guidance and streamlined processes, consider utilizing the USLegalForms platform to simplify your tax form submissions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.