Loading

Get India Kotak Mahindra Bank Form 281 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Kotak Mahindra Bank Form 281 online

Filling out the India Kotak Mahindra Bank Form 281 online is an essential task for users needing to make tax payments. This guide provides step-by-step instructions to help users navigate the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

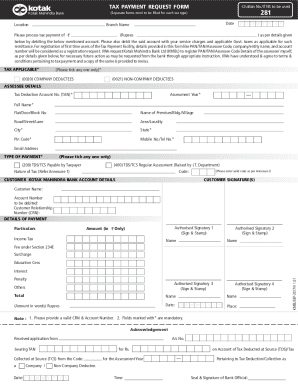

- Fill in the 'Challan No./ITNS' field, which should be noted as 281, to identify the type of tax payment you are making. Ensure you submit separate forms for each tax type you are addressing.

- Enter the date of payment in the format 'DD MM YYYY'. This information is crucial to record the timing of your remittance.

- Specify the branch name where your Kotak Mahindra Bank account is held.

- Input the amount of money you are remitting for tax payment. Make sure to provide the exact figure you wish to debit from your account.

- Select the applicable tax type by ticking the box for either 'Company Deductees' or 'Non-Company Deductees' under the 'Tax Applicable' section.

- In the 'Assessee Details' section, fill out each required field, including your Tax Deduction Account Number (TAN), assessment year, full name, and address details including pin code, mobile number, and email address.

- Choose your type of payment by ticking the appropriate box for either 'TDS/TCS Payable by Taxpayer' or 'TDS/TCS Regular Assessment'.

- Fill in the details for the nature of tax using valid codes as per annexure I that relates to the specific payment.

- Complete the 'Customer Signature(s)' section. If required, have multiple authorized signatories sign and stamp as necessary.

- Input customer account details that need to be debited for the payment, including customer name, account number, and customer relationship number (CRN).

- Provide breakdown details of the payment, including applicable fees, penalties, and charges under various tax-related fields and ensure the total amount matches your intended payment.

- Once all sections are completed, review your entries for accuracy, then save your changes, download the filled form, print a copy for your records, or share it as required.

Complete your tax payment documents online today for a smooth and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Open the Kotak 811 App and login by MPIN or Biomatrics. After logging in, choose the Account statement from the Bank category. Select the statement period like 1 month, 3 months, 6 months. You may download statements by custom date range.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.