Loading

Get Sentry 401k Plan Withdrawal Request Form 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sentry 401k Plan Withdrawal Request Form online

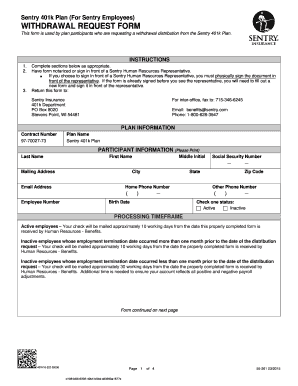

Filling out the Sentry 401k Plan Withdrawal Request Form online is a straightforward process designed to assist participants in requesting a distribution from their 401k plan. This guide offers step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal details in the 'Participant Information' section. Enter your last name, first name, middle initial, mailing address, city, state, zip code, home phone number, other phone number, email address, employee number, and social security number.

- In the 'Withdrawal Options' section, select the reason for your withdrawal. Choose the appropriate date related to your employment termination or retirement.

- For the 'Payment Option,' select whether you want a single sum payment, direct rollover, or purchase an annuity. Make sure to enter the relevant details for any selected option.

- If you are applying for a hardship withdrawal, complete the additional sections regarding acknowledgment, purpose, and amount of withdrawal.

- Once all necessary sections are completed, review the entire form for accuracy.

Complete your Sentry 401k Plan Withdrawal Request Form online today!

Related links form

To initiate a 401k withdrawal from Sentry, you need the Sentry 401k Plan Withdrawal Request Form. This form is specifically designed to collect all necessary information related to your withdrawal request. You can find it through the Sentry portal or websites like USLegalForms that can assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.