Loading

Get 2005 M1r, Age 65 Or Older/disabled Subtraction - Minnesota ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2005 M1R, Age 65 or older/Disabled subtraction - Minnesota online

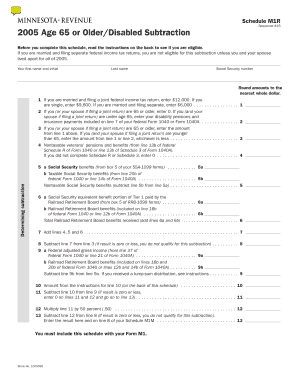

Filling out the 2005 M1R form can be a straightforward process if you have the right guidance. This guide will help you understand each component of the form and provide you with step-by-step instructions for completing it online.

Follow the steps to complete your 2005 M1R form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the instructions on the back of the form to determine your eligibility for the subtraction prior to filling out any information.

- Input your first name and initial in the designated field, followed by your last name. Ensure that this matches the information on your identification.

- Enter your Social Security number in the appropriate field to ensure proper identification.

- Round amounts to the nearest whole dollar as required throughout the form.

- Follow the instructions for the determining subtraction section. If you are married filing jointly, enter $12,000; if single, enter $9,600; if married filing separately, enter $6,000.

- If you or your spouse is 65 or older, input '0' in the corresponding field. If under 65, input your disability pensions and insurance payments as specified.

- Transfer the appropriate amount to Line 3 based on previous entries and follow the subsequent calculations for Lines 4, 5, 6, and beyond as indicated in the form.

- Complete the calculations pertaining to Social Security benefits, Railroad Retirement Board benefits, and verify totals for accurate line entries.

- Review all lines leading up to the final calculation on Line 13, checking for any zero or negative outcomes that would disqualify you from the subtraction.

- Once you have filled the form completely, you can save your changes, download a copy, print it, or share it accordingly.

Complete your forms online to ensure a smooth and efficient filing process.

The amount of Social Security disability benefits in Minnesota varies based on your work history and the severity of your disability. Generally, individuals can receive benefits ranging from several hundred to over a thousand dollars monthly. For those eligible, utilizing the 2005 M1R, Age 65 Or Older/Disabled Subtraction - Minnesota may help in maximizing their benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.