Get 2012 M1mt, Alternative Minimum Tax - Minnesota Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 M1MT, Alternative Minimum Tax - Minnesota Department Of Revenue online

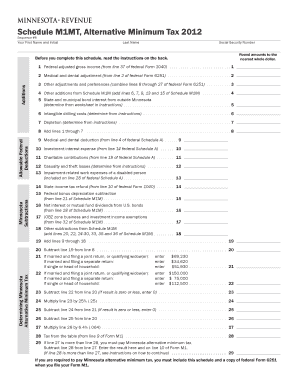

Filling out the 2012 M1MT schedule online is essential for individuals required to determine their Minnesota alternative minimum tax. This guide provides clear, step-by-step instructions for successfully navigating each section of this important tax form.

Follow the steps to complete the 2012 M1MT form online.

- Click ‘Get Form’ button to acquire the M1MT form and access it in your digital editor.

- Begin by entering your first name and initial as well as your last name in the designated fields. Ensure this information is accurate.

- Input your Social Security Number in the appropriate field. Correct entry is crucial for identification purposes.

- For line 1, provide your federal adjusted gross income as reported on line 37 of your federal Form 1040.

- Continue to line 2 to enter any medical and dental adjustments you are eligible for as indicated on line 2 of federal Form 6251.

- On line 3, add any other adjustments and preferences by summing the appropriate lines from federal Form 6251.

- For line 4, include other additions from Schedule M1M, specifically the amounts from lines 6, 7, 9, 13, and 15.

- On lines 5, 6, and 7, enter the specified amounts related to state and municipal bond interest outside Minnesota, intangible drilling costs, and depletion, referencing the accompanying instructions for calculations.

- Add all values from lines 1 through 7 to complete line 8.

- Proceed to line 9, entering your medical and dental deduction from line 4 of the federal Schedule A.

- For line 10, state your investment interest expense from line 14 of the federal Schedule A.

- Continue with line 11 for charitable contributions as found on line 19 of the federal Schedule A.

- Include casualty and theft losses as calculated per instructions in line 12.

- If relevant, enter impairment-related work expenses on line 13, ensuring you have collected the correct data from your federal Schedule A.

- On line 14, input any state income tax refund shown on line 10 of your federal Form 1040.

- For lines 15 to 18, enter the appropriate subtractions based on the federal return as indicated in the form.

- Calculate the total for lines 9 through 18 on line 19 and write it down.

- Complete line 20 by subtracting line 19 from line 8.

- Depending on your filing status, enter the specified amounts on the appropriate lines 21 and 22.

- Determine line 23 by subtracting line 22 from line 20; if the result is zero or negative, enter 0.

- Multiply line 23 by 0.25 and write the result on line 24.

- Subtract line 24 from line 21 for line 25; again, if this results in zero or less, enter 0.

- Complete line 26 by subtracting line 25 from line 20.

- On line 27, multiply line 26 by 0.064.

- Record the tax from line 9 of Form M1 on line 28.

- Evaluate line 29; if line 27 exceeds line 28, subtract and enter that amount. Otherwise, enter zero.

- Make sure to include this schedule and a copy of federal Form 6251 when submitting your Form M1 online.

- After verification, save changes, download, or print the completed form for your records.

Complete your documents online with confidence and ensure accuracy in your tax filings.

You might be paying Alternative Minimum Tax if your income exceeds certain thresholds or if you have certain deductions that the IRS does not allow under AMT rules. This tax is designed to ensure that individuals with high incomes contribute a minimum amount of tax, thereby preventing them from leveraging deductions to reduce their tax liability excessively. Consulting the 2012 M1MT, Alternative Minimum Tax - Minnesota Department Of will provide clarity and help determine your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.