Loading

Get Or Wine Board Tax Report 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Wine Board Tax Report online

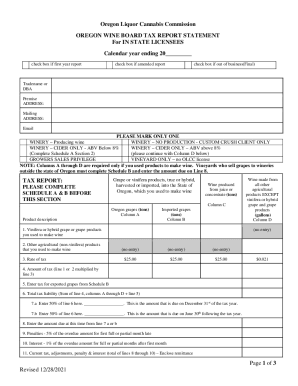

Filing the OR Wine Board Tax Report online is an important step for individuals and businesses in the wine industry in Oregon. This comprehensive guide will walk you through each section of the report, ensuring that you understand how to accurately complete the form while meeting state requirements.

Follow the steps to successfully complete the OR Wine Board Tax Report online.

- Press the ‘Get Form’ button to obtain the OR Wine Board Tax Report and open it in your preferred editor.

- Begin by filling in your tradename or doing business as (DBA) name, along with the premise address and mailing address.

- Indicate your email address for correspondence regarding your submission.

- Select only one option that applies to your operation from the list provided (e.g., winery, custom crush client, etc.). Make sure to check the appropriate box.

- If applicable, complete Schedule A before going to the tax report section. Ensure you have provided details about all grape or agricultural products used.

- In the tax report section, fill in the required columns A through D with accurate data regarding the types and quantities of grapes and agricultural products used.

- Calculate your total tax liability based on the rates provided (e.g., $25.00 per ton or $12.50 for exported grapes) and enter the amounts as required.

- Provide the penalty and interest amounts for any overdue payments, if applicable.

- Once all sections have been completed, review the report for accuracy and completeness.

- Save your changes, and opt to download, print, or share the submitted form as necessary.

To ensure compliance, complete your OR Wine Board Tax Report online today.

INSTRUCTIONS PRIVILEGE TAX SCHEDULE 4 All Malt and Wine Products shipped outside of Oregon must be reported on this schedule, including consignment merchandise. The credit is only allowed on Product that the State tax has been paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.