Get Part Vii Certificate Of Collection Or Deduction Of Tax (see ... - Softax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the PART VII Certificate Of Collection Or Deduction Of Tax (See ... - Softax online

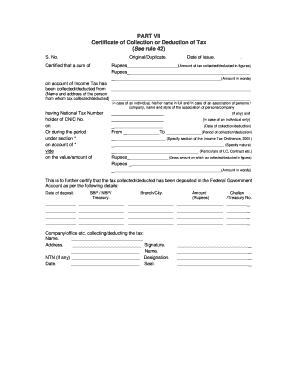

The PART VII Certificate of Collection or Deduction of Tax is a crucial document used to certify the collection or deduction of income tax from individuals or entities. Filling out this form accurately is important for compliance with tax regulations and ensures proper record-keeping.

Follow the steps to successfully complete the PART VII Certificate of Collection or Deduction of Tax.

- Select the ‘Get Form’ button to obtain the PART VII Certificate of Collection or Deduction of Tax and open it in your preferred online editor.

- In the section labeled ‘S. No.’, enter a unique reference number for this transaction.

- Indicate whether this is an Original or Duplicate certificate by selecting the appropriate option.

- In the ‘Certified that a sum of’ field, specify the amount of income tax that has been collected or deducted.

- Write the amount of tax collected or deducted in figures in the space provided next to ‘Rupees’.

- In the corresponding field, write the amount in words for clarity.

- Input the name and address of the person from whom the tax was collected or deducted.

- If the taxpayer is an individual, include their full name; if an association or company, provide its full name.

- Provide the National Tax Number (NTN) and, if applicable, the CNIC number of the individual or organization.

- Specify the date of collection or deduction in the designated date field.

- Identify the period during which the collection or deduction occurred.

- Specify the relevant section of the Income Tax Ordinance, 2001 that applies to this transaction.

- Detail the nature of the transaction related to the tax collection or deduction.

- If applicable, mention particulars of the Letter of Credit (LC), contract, etc.

- Provide the gross amount on which the tax was collected or deducted in figures.

- Write the gross amount in words for verification purposes.

- Certify that the tax has been deposited in the Federal Government account by filling out the deposit details, including the date, bank name, branch/city, amount, and treasury number.

- Complete the details regarding the company or office collecting or deducting the tax, including name, address, and signature.

- Make sure to add the designation, NTN (if available), and date before sealing the document.

Complete your document online to ensure correct filing and compliance with tax regulations.

Choosing between claiming 0 or 1 for tax withholding depends on your financial situation and how you want to manage your tax refund. Claiming 0 may result in higher withholding, while claiming 1 could lead to a smaller refund. Understanding the implications of your choice is essential. The PART VII Certificate Of Collection Or Deduction Of Tax (See ... - Softax) can provide clarity on how these choices affect your tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.