Loading

Get Rpu-13-ax - Illinois Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RPU-13-AX - Illinois Department Of Revenue online

Filling out the RPU-13-AX form is an essential task for those involved in the distribution of electricity in Illinois. This guide provides a clear and comprehensive approach to completing the form online, ensuring that you submit accurate information.

Follow the steps to fill out the RPU-13-AX form with ease.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

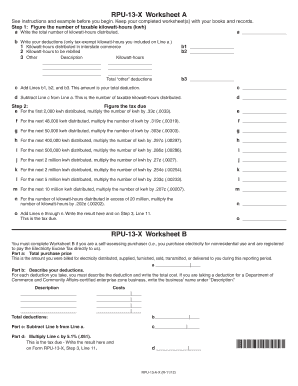

- Begin with RPU-13-X Worksheet A. In part a, input the total number of kilowatt-hours distributed during the reporting period.

- In part b, write down your deductions for tax-exempt kilowatt-hours. Fill out lines b1 through b3, specifying the amount for interstate commerce, rebilled kilowatt-hours, and any other deductions.

- Calculate your total deductions by adding lines b1, b2, and b3, and write the total on line c.

- Subtract the total deductions (line c) from the total kilowatt-hours (line a) to determine the number of taxable kilowatt-hours distributed. Write this amount on line d.

- Now, figure out the tax due for different ranges of kilowatt-hours. Complete lines e through n by multiplying the appropriate number of kilowatt-hours for each range by the respective tax rate.

- Add all calculated tax amounts from lines e through n. Write the result on line o, which represents the total tax due.

- If applicable, complete Worksheet B. Report the total purchase price in part a, describe your deductions in part b, and calculate the net amount in part c.

- Finally, multiply the amount from part c by 5.1% in part d to find the tax due, and document it appropriately.

- After all entries are completed, users can save changes, download, print, or share the form as needed.

Start filling out your RPU-13-AX form online today!

You should send your Illinois tax payment to the address specified on your tax return form. Typically, payments for individuals go to the Illinois Department of Revenue, P.O. Box 19044, Springfield, IL 62794-9044. Make sure to check your specific form for any variations in the address, as it can differ based on taxes owed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.