Get You Must File Form Il-941 If You Paid Amounts Subject To Illinois Withholding Income Tax (either

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the You Must File Form IL-941 If You Paid Amounts Subject To Illinois Withholding Income Tax (either online

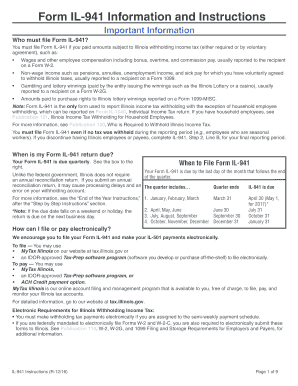

Filing Form IL-941 is essential for those who have made payments subject to Illinois withholding income tax. This guide provides clear, step-by-step instructions to help you accurately complete the form online, ensuring compliance with Illinois tax regulations.

Follow the steps to successfully complete your Form IL-941.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your information by entering the necessary details and checking any relevant boxes. Ensure your sequence number is correctly recorded as '000' unless otherwise assigned.

- Indicate the reporting period by selecting the correct quarter. Remember, if you have no withholding to report, you must still file one return for each quarter.

- If this is your fourth quarter return or marks the end of your withholding, complete Items A and B. Item A requires entry of the total number of W-2 forms issued for the year. Item B should be checked if applicable.

- Enter the total amounts subject to withholding in Line 1, including payroll, non-wage income, and gambling winnings. Do not leave this blank; if none exist, enter zero.

- Step 4 requires entering the exact amount of Illinois income tax withheld on the specific dates payments were made. Ensure to total these amounts for the quarter.

- In Step 5, report payments and credits used to satisfy your liability. Follow the order specified on the form.

- Calculate your balance due in Step 6. Ensure no entries are negative and that your figures match correctly.

- Finally, sign the form in Step 7. Ensure the authorized person signs and dates the form to validate the submission.

- Once completed, save changes, download, print, or share the form as necessary.

Complete your Form IL-941 online today for a straightforward filing experience.

Individuals earning income from work performed in Illinois are generally subject to Illinois income tax. This includes residents and non-residents who earn income within the state. Various types of income, including wages, salaries, and business income, fall under this tax requirement. Always ensure compliance, especially if you are handling payments subject to Illinois withholding income tax; remember that you must file Form IL-941 if you have such payments.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.