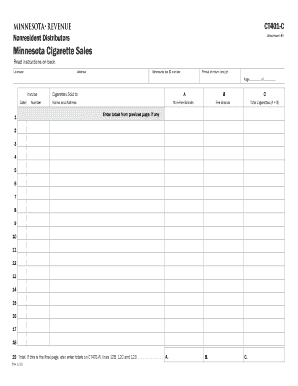

Get Ct401-c, Minnesota Cigarette Sales (for Nonresident Distributors)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT401-C, Minnesota Cigarette Sales (for Nonresident Distributors) online

This guide provides clear, step-by-step instructions for filling out the CT401-C form, which is required for reporting cigarette sales in Minnesota by nonresident distributors. By following these instructions, you will efficiently complete the form online and ensure compliance with the local regulations.

Follow the steps to fill out the CT401-C form accurately.

- Select the 'Get Form' button to access the CT401-C form and open it in your editor.

- Fill in your licensee information, including your name, address, and Minnesota tax ID number. Ensure that all details are accurate and up to date.

- Indicate the period of return by entering the month and year for which you are reporting sales.

- Begin the invoice section by entering the date and invoice number that corresponds to your sales.

- For each customer, provide their name and address in section A. This includes the details of the individuals or entities to whom you sold cigarettes.

- Report the cigarettes sold under non-fee brands in section B. Non-fee brands refer to those produced by manufacturers who have agreements with the state.

- In section C, report the cigarettes sold under fee brands. These are produced by manufacturers that do not have agreements with the state.

- Calculate the total number of cigarettes sold by adding the figures from sections A and B. Enter this total in the designated section for total cigarettes.

- If there are any totals from previous pages, enter them at the appropriate field as instructed.

- Once all sections are complete, review your entries for accuracy and make any necessary corrections.

- After confirming all information is correct, save your changes and prepare to download or print the form for submission.

Complete your CT401-C form online today to ensure your compliance with Minnesota cigarette sales reporting.

Tobacco products, including cigarettes, are expensive in Minnesota due to high state taxes and fees imposed on their sale. The state aims to reduce smoking rates and improve public health, which results in higher costs. For nonresident distributors navigating CT401-C, Minnesota Cigarette Sales, understanding the tax structure is essential to manage expenses effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.