Loading

Get 2003 Es Atc 620

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 ES ATC 620 online

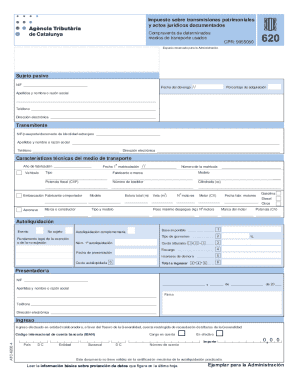

The 2003 ES ATC 620 form is essential for reporting transfers of property and documented legal actions related to the sale of certain used transportation means. This guide provides step-by-step instructions to help users complete the form online efficiently.

Follow the steps to complete the 2003 ES ATC 620 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the 'Sujeto pasivo' section with your identification number (NIF), name or company title, phone number, and email address.

- In the 'Transmitente' section, enter the seller's identification number or passport/document ID, full name or company title, contact number, and email.

- Provide details about the transportation means in the 'Características técnicas del medio de transporte' section, including the year of manufacture, type, model, registration number, and engine specifications.

- Indicate whether the transaction is subject to autoliquidación and provide any necessary legal foundations for the exemption if applicable.

- Complete the autoliquidación section by entering the date of submission, tax base, tax rate, tributes, fees, and any penalties or interest as necessary.

- Fill in the presenter’s information including their identification number, name or company title, contact information, and signature.

- Provide payment information, including IBAN, bank details, and the amount in euros.

- Review all entered information to ensure accuracy and completeness.

- Save changes, then download, print, or share the completed form as required.

Complete your documents online today for an efficient and streamlined experience.

Filing a return under section 170a requires you to document your charitable donations properly. You will typically need to itemize these contributions on Schedule A of your 1040 form. This aspect of your return can significantly influence your overall tax picture, including areas covered by the 2003 ES ATC 620, so consult resources like uslegalforms to navigate this effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.