Loading

Get 2016 Es Atc S10 (spain)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2016 ES ATC S10 (Spain) online

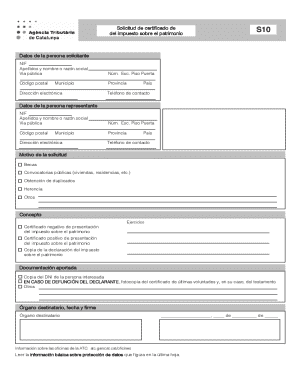

Filling out the 2016 ES ATC S10 form online is a straightforward process that allows users to submit their request efficiently. This guide provides detailed step-by-step instructions to help users navigate each section of the form with ease.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the personal details of the applicant in the relevant fields. This includes the NIF (tax identification number), last name and first name or business name, address information (public way, number, floor, and door), postal code, province, municipality, email address, country, and contact telephone number.

- If applicable, provide the representative's information in the designated section, filling out the same fields as for the applicant.

- Specify the reason for the application by choosing from the provided options such as scholarships, public calls, obtaining duplicates, inheritance, or others.

- Indicate the concept by selecting options related to the submission of the wealth tax, whether it is a negative certificate, a positive certificate, or a copy of the tax declaration.

- Attach the required documentation, such as a copy of the DNI (national identification document) of the interested person. If the declaration relates to a deceased individual, include a photocopy of the certificate of last wills and if applicable, the will.

- Complete the destination authority field along with the date and your signature.

- Review all filled information for accuracy and completeness. Once confirmed, users can save changes, download, print, or share the form as needed.

Begin your online submission process now to ensure a timely application.

To obtain your NRC code in Spain, you must first process a tax payment through the designated channels. Once completed, the NRC code will be generated as a confirmation of the transaction. When handling matters related to the 2016 ES ATC S10 (Spain), adhering to this process is vital for maintaining accurate tax records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.