Loading

Get Nc D-400 Schedule S 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC D-400 Schedule S online

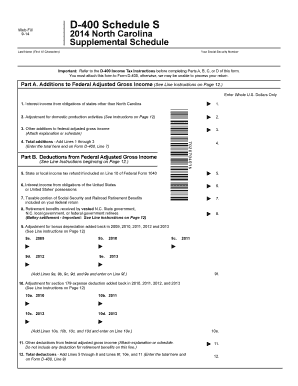

The NC D-400 Schedule S is an essential form for reporting additions and deductions to federal adjusted gross income in North Carolina. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring you can efficiently navigate the process.

Follow the steps to successfully complete the NC D-400 Schedule S.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete your personal information section by entering your Social Security number and last name as it appears on your tax documents.

- In Part A, report any additions to your federal adjusted gross income. Input any interest income from obligations of states other than North Carolina, adjustments for domestic production activities, and any other additions as necessary. Sum these amounts and enter the total on Line 4.

- Proceed to Part B to detail deductions from your federal adjusted gross income. Follow the line instructions carefully, reporting any applicable state or local income tax refunds, interest income, taxable Social Security benefits, and other deductions outlined in the form. Calculate the total deductions and enter the amount on Line 12.

- For Part C, determine whether to claim the N.C. standard deduction or complete the itemized deductions. If using itemized deductions, carefully enter the values for qualifying home mortgage interest, real estate property taxes, and charitable contributions. Add these values together for your total N.C. itemized deductions, which you will enter on Line 19.

- In the final section, Part D, if you are a part-year resident or nonresident, fill out the applicable information concerning your residency dates. Follow the worksheet guidance provided to correctly enter the amounts on Lines 20 and 21, and divide these figures as instructed. Conclude by entering Line 22 as required.

- Once all sections are completed, review your responses to ensure accuracy. You can then save changes, download, print, or share the form as needed.

Begin filling out your NC D-400 Schedule S online to ensure a smooth tax filing process.

The number of allowances you should claim in North Carolina typically depends on your personal situation, such as your income, tax deductions, and any dependents. It is wise to use the IRS worksheets or the NC D-400 Schedule S as resources to help you determine the appropriate number. Properly claiming allowances can lead to more accurate withholding and a better tax outcome.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.