Loading

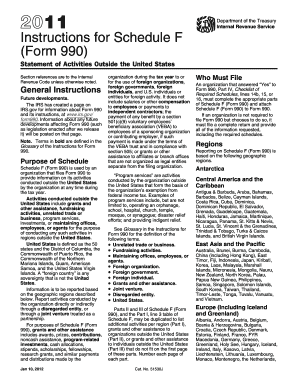

Get 2011 Instruction 990 Schedule F. Instructions For Schedule F (form 990), Statement Of Activities

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Instruction 990 Schedule F. Instructions For Schedule F (Form 990), Statement Of Activities online

Filling out the 2011 Instruction 990 Schedule F is crucial for organizations that conduct activities outside the United States. This guide provides step-by-step instructions to help users complete the form accurately and efficiently while ensuring compliance with IRS regulations.

Follow the steps to successfully complete Schedule F online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Review the purpose of Schedule F. Ensure that your organization qualifies to file this schedule by confirming if you answered 'Yes' to specific questions on Form 990 related to foreign activities.

- Complete Part I which requires general information on activities outside the United States. Report all activities conducted by the organization and maintain records of expenditures.

- Fill columns in Part I for each geographic region concerning grants, fundraising, and any program services conducted. Enter the details of each activity and use appropriate regions as listed.

- If your organization made grants or other assistance, proceed to complete Part II for grants to organizations outside the U.S. Report only those recipients that received more than $5,000 during the tax year.

- In Part II, specify the region of the recipient, describe the purpose of the grant, and list the total amounts granted. Be specific in detailing how the funds will be used.

- If applicable, move on to Part III for reporting grants and assistance to individuals outside the U.S. Clearly detail the types of assistance provided and the methods of cash disbursement.

- Complete Part IV by answering the questions that determine if you need to file additional foreign forms. Ensure you address each line accurately based on your organization’s activities.

- Finally, use Part V to provide any supplemental information or narrative explanations that support the answers given in the preceding sections.

- Review all entries for accuracy, and once completed, users can save changes, download the form, print, or share it as necessary.

Begin filling out your Schedule F online to ensure timely and accurate submission.

Schedule F income typically includes revenue generated from activities directly tied to a nonprofit's service offerings. This might encompass grants, program fees, or contributions linked to specific programs. Understanding what qualifies as Schedule F income is crucial for accurate reporting and is well-explained in the 2011 Instruction 990 Schedule F.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.