Get Us Importer Questionnaire - Usitc - Usitc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the US Importer Questionnaire - USITC - Usitc online

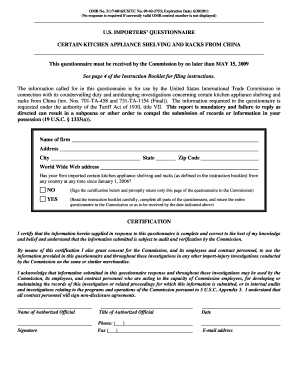

Completing the US Importer Questionnaire is essential for businesses involved in importing certain kitchen appliance shelving and racks from China. This guide provides a clear, step-by-step approach to successfully filling out this form online, ensuring that you meet all necessary requirements.

Follow the steps to accurately complete the US Importer Questionnaire online.

- Press the ‘Get Form’ button to access the questionnaire and open it in the editor.

- Begin by filling in your firm’s name, address, state, city, zip code, and your website address in the designated fields.

- Indicate whether your firm has imported certain kitchen appliance shelving and racks from any country since January 1, 2006. If the answer is 'NO,' sign the certification and submit the first page. If 'YES,' proceed to complete the entire questionnaire.

- In the certification section, provide the name and title of the authorized official, the date, and include their signature. Also, include a phone number and email address for follow-up.

- Continue to Part II, where you will provide detailed trade and related information. Answer questions regarding the nature of your firm’s importing operations, any related firms, and your firm's import activities.

- Detail your firm’s imports of certain kitchen appliance shelving and racks from China and any other sources in the subsequent sections. Fill in the quantity and value for each calendar year as requested.

- Conclude by entering comments or suggestions regarding the questionnaire, if applicable, and review all entries for accuracy before submission.

- After completing the form, save the changes, download a copy, or print it for your records. Ensure that you share the form as required and submit it to the Commission by the due date.

Ready to complete the US Importer Questionnaire online? Start now to ensure your compliance and timely submission.

No, the importer number is not the same as the EIN, although they can be related. The importer number is specifically assigned by CBP for customs purposes, while the EIN is your business’s tax identification number. For further clarification on these distinctions and how to navigate them, consider referencing the US Importer Questionnaire - USITC - Usitc for a clearer understanding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.