Loading

Get Mi 5094 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5094 online

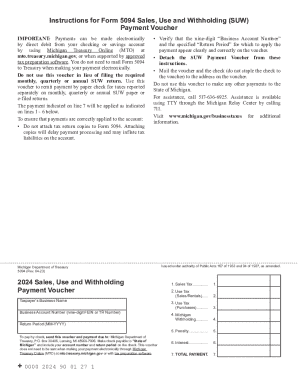

The MI 5094 is a vital form for remitting payments related to sales, use, and withholding taxes in Michigan. This guide provides detailed, step-by-step instructions on how to complete the MI 5094 online, ensuring that every user can navigate the process with ease.

Follow the steps to fill out the MI 5094 online.

- Click the ‘Get Form’ button to access the MI 5094. This action will open the form in the online editor for your convenience.

- Begin by entering the taxpayer's business name in the designated field. Ensure that the name matches the records associated with your Business Account Number.

- Input the business account number, which is a nine-digit FEIN or TR Number. This number is critical for correctly applying your payment.

- Specify the return period for which the payment is being made. Use the format MM-YYYY to ensure clarity and accuracy.

- In the sections labeled 1 to 6, enter the respective amounts for sales tax, use tax for sales/rentals, use tax for purchases, Michigan withholding, penalty, and interest as applicable.

- Calculate the total payment and enter this amount in line 7. Review all entries for accuracy before proceeding.

- Once all fields are complete, you can save your changes, download the form, or share it as necessary. Make sure to keep a copy for your records.

Start completing the MI 5094 online today for seamless tax payment processing.

The Michigan sales tax credit for 2025 aims to provide relief to residents by offering a refund based on specific qualifying expenses. As rates and credits can change, it is essential to stay informed about updates, especially those related to MI 5094. Utilize platforms like uslegalforms to learn more about how to apply for and benefit from this credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.