Get /b Bapplication/b Is Invited For Investment In The Separately Managed Accounts B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application for Investment in the Separately Managed Accounts online

Filling out the Application for Investment in the Separately Managed Accounts is a straightforward process. This guide provides step-by-step instructions to assist you in completing the application accurately and effectively.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

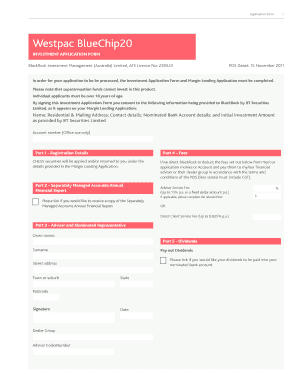

- Complete Part 1 - Registration Details, ensuring that you provide accurate information necessary for securities transfers. This section must be in an acceptable format to the securities registrars.

- In Part 2, indicate whether you would like to receive a copy of the Separately Managed Accounts Annual Financial Report.

- Fill out Part 3 with your adviser’s details and any fees agreed upon in Part 4, such as the Adviser Service Fee or Direct Client Service Fee.

- If you wish to have dividends paid into your nominated bank account, complete Part 5 - Dividends.

- Sign and date Part 6 - Declaration and Signature. Ensure that all required signatures are provided if it is a joint application.

- Submit the completed form to the designated address, along with any necessary margin lending documents, and ensure payment is made according to the specified methods.

- After submission, retain a copy of your application and any relevant documents for your records. Monitor your email or designated communication for updates on your application.

Begin your investment application process online to secure your financial future.

A separately managed account is not classified as an investment company; rather, it is a personalized investment vehicle tailored for an individual investor. Unlike investment companies, which pool assets for broader investment strategies, SMAs focus solely on the preferences of the individual. So, as you explore your investment route, consider how an /b BApplication/b Is Invited For Investment In The Separately Managed Accounts B can align with your unique financial goals.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.