Loading

Get Ut Tc-40w 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-40W online

The UT TC-40W is an essential form for reporting Utah withholding tax. This guide provides clear and detailed instructions on how to complete the form online, making the process straightforward for all users.

Follow the steps to complete the UT TC-40W online.

- Click ‘Get Form’ button to obtain the UT TC-40W and open it in your preferred editing tool.

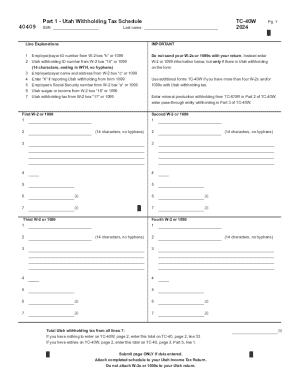

- Begin filling out Part 1 by entering your Social Security number (SSN) and last name at the top of the form. Ensure that the name matches the name on your tax documents.

- Provide your employer or payer ID number, which is found in box 'b' of your W-2 or 1099. This will identify your employer.

- Next, enter the Utah withholding ID number found in box '15' of your W-2 or 1099. Make sure it is a 14-character number ending in WTH, with no hyphens.

- Fill in the employer or payer's name and address as listed in box 'c' of your W-2 or 1099.

- If applicable, mark an 'X' in the box indicating you are reporting Utah withholding from a form 1099.

- Enter your total Utah wages or income, as reported in box '16' of your W-2 or 1099, in the appropriate field.

- Next, input the Utah withholding tax amount, which can be found in box '17' of your W-2 or 1099.

- If you have more than four W-2s or 1099s to report, utilize additional TC-40W forms as necessary to provide all required information.

- After completing all relevant sections for your W-2s or 1099s, calculate your total Utah withholding tax and enter it in the designated field at the end of Part 1.

- If there are no entries on the TC-40W, refer to the instructions for the TC-40 for further filing steps. If there are entries, ensure to attach the completed TC-40W to your Utah Income Tax Return.

Complete your UT TC-40W online today and streamline your tax reporting process.

Utah form TC-40W is a tax withholding form used to calculate state tax on your income. This important document allows you to provide necessary information about your wages, exemptions, and filing status. By accurately completing the TC-40W, you can ensure your tax withholding aligns with your expected tax liability. For easier access and guidance, consider utilizing resources from uslegalforms to help navigate the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.