Loading

Get Fidelity Life Association 3451-fla-04 2004-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Life Association 3451-FLA-04 online

This guide provides clear instructions on how to complete the Fidelity Life Association 3451-FLA-04 form online. Users will find step-by-step assistance to ensure that their submissions are accurate and complete.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

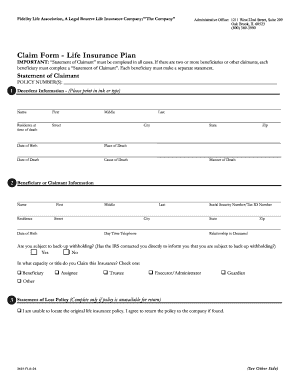

- Enter the policy number(s) in the field provided at the top of the form.

- For section 1, provide the decedent's information. Print clearly in ink or type their first, middle, and last name, along with their residence at the time of death. Include the city, state, zip code, date of birth, place of death, date of death, cause of death, and manner of death.

- In section 2, fill out the beneficiary or claimant information. Enter the name, residence, date of birth, social security number or tax ID number, and daytime telephone number of the claimant. Specify their relationship to the deceased.

- Answer if you are subject to back-up withholding as required. Indicate the capacity or title in which you claim this insurance by checking the appropriate box such as Beneficiary, Assignee, or Executor/Administrator.

- Section 3 must be completed only if the original insurance policy is unavailable. State that you are unable to locate the original policy and agree to return it if found.

- In section 4, select the payment option for the fund. Choose between single sum payment or installment payments. If you select installment payments, specify the installment option and frequency. This may include monthly, quarterly, semi-annually, or annually.

- In section 5, provide your signature, indicating your claim to the insurance. Include the date and print your name clearly. If an agent is involved, they should also provide their signature, date, and agent number.

- If notarization is required, complete the notary section, ensuring it is signed and dated appropriately.

- Review all entries for accuracy. Save the completed form, then download, print, or share it as needed.

Complete your forms online today to ensure your claims are processed efficiently.

Related links form

Fidelity Life Association 3451-FLA-04 is a mutual insurance company, meaning it is owned by its policyholders. This structure allows policyholders to benefit from the company's profits, reinforcing Fidelity Life's commitment to customer-focused service. With this ownership model, you can feel confident that your needs are at the forefront of their operations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.