Loading

Get Oh It 10 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH IT 10 online

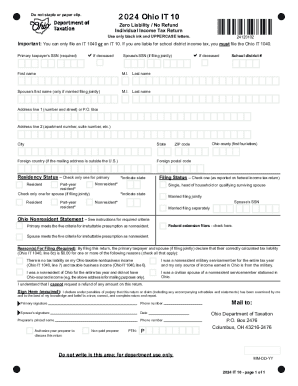

The OH IT 10 form is designed for individuals in Ohio who do not have a tax liability for the year. This guide will provide you with clear, step-by-step instructions to successfully complete the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the OH IT 10 form accurately.

- Click the ‘Get Form’ button to access the OH IT 10 online version. This allows you to open the form in an editable format.

- Enter the primary taxpayer's Social Security Number (SSN) in the designated field. If the primary taxpayer is deceased, check the appropriate box.

- For those filing jointly, fill in the spouse’s SSN, first name, middle initial, and last name. Ensure all names match official documents.

- Provide the full mailing address, including address line 1, address line 2 (if applicable), city, state, ZIP code, and foreign country details if necessary.

- Select the residency status of the primary taxpayer and spouse. Remember to check only one box each.

- Choose your filing status as per the options that align with your federal tax return. Be sure to note if you are a nonresident.

- If applicable, check the box for federal extension filers and confirm if the primary or spouse meets the criteria for being considered a nonresident.

- Indicate the reason(s) for filing, ensuring you check all applicable boxes that reflect your tax situation.

- Sign the form in the designated areas for both the primary taxpayer and the spouse, if applicable. Include your phone numbers and date of signing.

- If a tax preparer completed the form, ensure their information is provided, including the preparer's printed name, phone number, and PTIN if applicable.

- Review the completed form for accuracy. Once satisfied, save your changes, print, or share the form as needed. Do not staple or paper clip.

Complete your OH IT 10 form online today for a hassle-free tax filing experience.

Filing Ohio sales tax online can be accomplished through the Ohio Department of Taxation website. You will need to create an account if you have not done so already. Once logged in, follow the prompts to complete your sales tax return, making sure to include all necessary details for accurate processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.