Loading

Get Oh Sutton Bank Hsa Rollover Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Sutton Bank HSA Rollover Form online

Completing the OH Sutton Bank HSA Rollover Form online is a straightforward process that allows you to transfer your Health Savings Account funds efficiently. This guide will walk you through each section of the form to ensure you provide all necessary information accurately.

Follow the steps to complete your HSA rollover form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- In the Date section, fill in the date of your rollover in the format ___/____/____, ensuring that you use the correct month, day, and year.

- Provide your full name in the Name field. Make sure to use your legal name as it appears on your identification documents.

- Fill in your date of birth in the appropriate field, entering the month, day, and year.

- Complete your Street Address, City, State, and Zip Code in the designated fields for your primary residence.

- If your mailing address is different from your residential address, fill in the Mailing Address, City, State, and Zip Code in the provided fields.

- Enter your Social Security Number in the designated field, ensuring accuracy as this information is crucial for processing.

- In the section labeled 'I authorize and direct,' provide the name of your current MSA/HSA Custodian/Trustee and your Account Number.

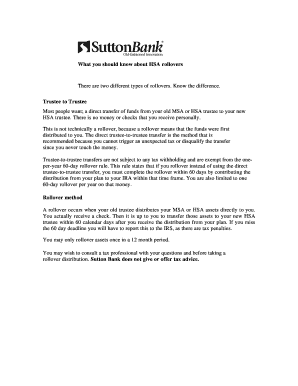

- Select the appropriate transfer option by marking the box for either 'Trustee to Trustee Transfer' or 'Direct MSA to HSA Rollover,' depending on your circumstances.

- Confirm that you have established or will establish a Health Savings Account with Sutton Bank by checking the accompanying statement.

- Read the certification statement and agree to the terms specified. This includes acknowledging that you are responsible for transfer eligibility and consulting a tax professional.

- Sign and date the form in the designated areas, ensuring that both the HSA Owner and Custodian/Trustee complete their respective signatures.

- Ensure to attach a statement from your current account as required for transfer requests.

- Once you have filled in all necessary sections, save your changes, and continue to download, print, or share the form as needed.

Start your HSA rollover process by completing the OH Sutton Bank HSA Rollover Form online today.

Form 1099-SA reports distributions from your HSA, while Form 5498-SA provides information about contributions made to your HSA during the tax year. Both forms serve different purposes but are vital for accurately reporting your HSA activities. Always keep these forms handy, especially when filling out the OH Sutton Bank HSA Rollover Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.