Loading

Get (and Your Spouse

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (and Your Spouse online

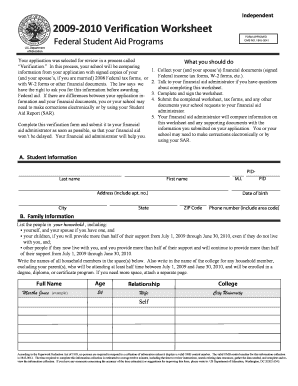

This guide provides a step-by-step approach to completing the (and Your Spouse form online. Properly filling out this form is essential for the verification process related to federal student aid, ensuring that your application is reviewed accurately.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to access the form and open it in an online editor.

- Begin by providing your personal information in Section A, including your full name, date of birth, address, and contact information. Ensure that all information is accurate and current.

- Move to Section B to list all members of your household. This should include yourself, your partner if applicable, your children whom you support, and any other individuals living with you for whom you provide more than half of their support. Include the college name for anyone attending school.

- In Section C, complete your tax forms and income information. Indicate whether you will be submitting your signed tax return, if your spouse is filing separately, or if you are not required to file. If applicable, provide details of any untaxed income received in 2008.

- If applicable, proceed to Section D to document your spouse’s tax forms and income information. Ensure the correct boxes are checked regarding tax returns and list any untaxed income similar to the previous section.

- Finally, fill out Section E by signing the worksheet to certify that all information provided is complete and correct. Remember, your partner’s signature is optional if you are married.

- Review all sections to verify the accuracy of the form. Once confirmed, you can save changes, download, print, or share the completed form with your financial aid administrator.

Complete your (and Your Spouse form online today to ensure your financial aid is processed without delay.

Filling out form VA 4 involves providing personal information such as your name, address, and Social Security number. You should also specify your filing status and any additional withholding amounts you desire. Your spouse's income status may also influence how you fill out this form, so it's a good idea to evaluate your joint financial situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.