Get Faqs - Online Payments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FAQs - Online Payments online

This guide provides clear and user-friendly instructions for navigating the FAQs regarding online payments. Whether you are a new user or need a refresher, this comprehensive resource will help you effectively manage your online payment inquiries.

Follow the steps to successfully navigate the FAQs - Online Payments.

- Press the ‘Get Form’ button to access the FAQs form. This will allow you to view and download the document for reference.

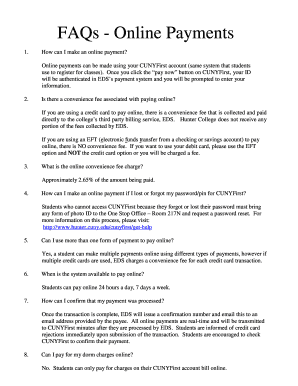

- Review the section titled 'How can I make an online payment?' This outlines the process of using your CUNYFirst account for payments. Ensure you have your account credentials ready.

- Check the FAQs regarding convenience fees associated with online payments. Understand the differences in fees when using a credit card versus an electronic funds transfer (EFT) to avoid unexpected charges.

- If you encounter issues with your CUNYFirst password, refer to the procedure for password recovery to regain access.

- Understand the limitations of online payments, such as the inability to pay for dorm charges and the requirement to be registered for classes before making a payment.

- Explore the options for confirming your payment after submission, including the importance of checking your email for a confirmation number from EDS.

- Familiarize yourself with the refund process, including how refunds are processed if a class is dropped before the semester starts.

- If applicable, review the conditions under which someone else can pay on your behalf, ensuring that they have access to your CUNYFirst account.

- Make note of the system availability for online payments which is accessible 24/7, allowing you to pay at your convenience.

- After completing your review of the FAQs, you can save changes, download, print, or share the FAQs document as needed.

To ensure your payments are processed smoothly, begin filling out your FAQs - Online Payments form today.

Filing taxes often depends on factors like your filing status and age, not just your income. If you made $5,000, you may not be required to file, especially if it falls below the minimum threshold set by the IRS. However, you might want to file even if it's not mandatory to claim potential credits or refunds. For specific guidance tailored to your situation, uslegalforms provides valuable tools and information regarding tax filing, which can help clarify your requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.