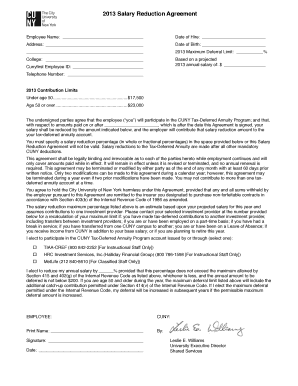

Get 2013 Salary Reduction Agreement Employee Name: Date Of Hire: Address: Date Of Birth: 2013 Maximum

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2013 Salary Reduction Agreement Employee Name: Date Of Hire: Address: Date Of Birth: 2013 Maximum online

Filling out the 2013 Salary Reduction Agreement is an essential process for employees participating in the CUNY Tax-Deferred Annuity Program. This guide provides clear, step-by-step instructions for completing the required sections of the agreement online, ensuring you understand each component involved.

Follow the steps to fill out your salary reduction agreement effectively.

- Click the ‘Get Form’ button to access the document and open it in your preferred editor.

- In the 'Employee Name' field, enter your full name as it appears in official records.

- Fill in the 'Date of Hire' with the exact date you began your employment.

- Provide your current address in the 'Address' section, ensuring it is accurate for any correspondence.

- Enter your 'Date of Birth' in the designated space to confirm your eligibility and age.

- Input the '2013 Maximum Deferral Limit' based on the guidelines provided, ensuring it aligns with your expected salary.

- State the 'Projected 2013 Annual Salary' clearly to calculate the deferral limit effectively.

- In the 'Cunyfirst Employee ID' field, enter your unique employee identification number.

- List your telephone number for any required follow-ups or clarifications regarding your agreement.

- Select the corresponding investment provider from the list to indicate where your deferred amounts will be directed.

- Specify the percentage to which you wish to reduce your salary, ensuring it does not exceed the maximum allowed.

- Once all fields are filled out, review your entries for accuracy, and then proceed to save, download, print, or share your completed form.

Complete your salary reduction agreement online today to ensure your participation in the CUNY Tax-Deferred Annuity Program.

Employers do not have to tax bonuses at the supplemental rate; however, they often choose to do so for simplicity. The supplemental rate can expedite the payroll process and ensure compliance with IRS regulations. Individuals participating in a 2013 Salary Reduction Agreement should be aware of how their bonuses will be taxed, allowing for better financial planning and management.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.