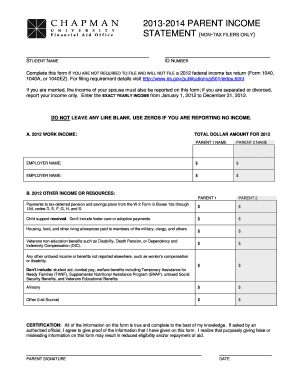

Get Statement (non-tax Filers Only)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign STATEMENT (NON-TAX FILERS ONLY) online

How to fill out and sign STATEMENT (NON-TAX FILERS ONLY) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Choosing a legal specialist, making an appointment and going to the workplace for a personal conference makes finishing a STATEMENT (NON-TAX FILERS ONLY) from beginning to end exhausting. US Legal Forms lets you rapidly generate legally-compliant papers based on pre-created browser-based templates.

Execute your docs in minutes using our easy step-by-step guideline:

- Get the STATEMENT (NON-TAX FILERS ONLY) you want.

- Open it up using the online editor and start adjusting.

- Fill in the empty areas; concerned parties names, places of residence and phone numbers etc.

- Change the template with smart fillable fields.

- Include the particular date and place your electronic signature.

- Click on Done following double-examining all the data.

- Save the ready-created papers to your device or print it out like a hard copy.

Swiftly generate a STATEMENT (NON-TAX FILERS ONLY) without having to involve professionals. There are already over 3 million people making the most of our rich catalogue of legal documents. Join us right now and get access to the #1 catalogue of online blanks. Try it out yourself!

How to edit STATEMENT (NON-TAX FILERS ONLY): personalize forms online

Finishing paperwork is more comfortable with smart online instruments. Get rid of paperwork with easily downloadable STATEMENT (NON-TAX FILERS ONLY) templates you can edit online and print out.

Preparing papers and paperwork must be more accessible, whether it is a regular element of one’s job or occasional work. When a person must file a STATEMENT (NON-TAX FILERS ONLY), studying regulations and instructions on how to complete a form correctly and what it should include might take a lot of time and effort. However, if you find the proper STATEMENT (NON-TAX FILERS ONLY) template, completing a document will stop being a challenge with a smart editor at hand.

Discover a wider range of functions you can add to your document flow routine. No need to print out, fill out, and annotate forms manually. With a smart editing platform, all the essential document processing functions are always at hand. If you want to make your work process with STATEMENT (NON-TAX FILERS ONLY) forms more efficient, find the template in the catalog, click on it, and discover a less complicated way to fill it in.

- If you want to add text in a random area of the form or insert a text field, use the Text and Text field instruments and expand the text in the form as much as you require.

- Use the Highlight instrument to stress the main parts of the form. If you want to hide or remove some text pieces, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic elements to it. Use the Circle, Check, and Cross instruments to add these components to the forms, if necessary.

- If you need additional annotations, use the Sticky note tool and put as many notes on the forms page as required.

- If the form requires your initials or date, the editor has instruments for that too. Minimize the chance of errors using the Initials and Date instruments.

- It is also possible to add custom visual elements to the form. Use the Arrow, Line, and Draw instruments to change the file.

The more instruments you are familiar with, the better it is to work with STATEMENT (NON-TAX FILERS ONLY). Try the solution that offers everything required to find and edit forms in a single tab of your browser and forget about manual paperwork.

An example of a non-filing letter from the IRS might document that you have not submitted a tax return for a given year, making it clear that you fall within the non-filer category. This letter typically includes your name, taxpayer identification number, and the tax years in question. Having such a letter provides proof of your non-filer status and can be beneficial in various situations. To simplify this process, consider utilizing USLegalForms to access templates and expert guidance on obtaining your statement (non-tax filers only).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.