Loading

Get Taxable Scholarships And Grants Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxable Scholarships And Grants Form online

Filling out the Taxable Scholarships And Grants Form is a critical step in ensuring your financial aid is processed correctly. This guide will provide you with clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to fill out the Taxable Scholarships And Grants Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

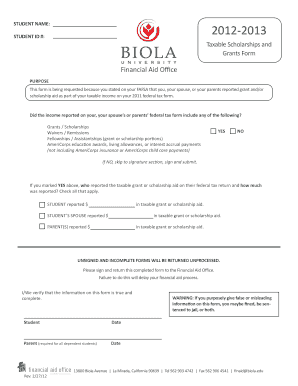

- Begin by reviewing the purpose section. This outlines why this form is required and the significance of reporting any taxable scholarships or grants. Ensure that you understand that the information provided should align with the Federal tax return.

- Indicate whether any reported income includes grants, scholarships, waivers, fellowships, or education awards. If you select 'YES', proceed to the next step. If you select 'NO', you can skip to the signature section.

- In the section where you report who included the taxable grant or scholarship on their federal tax return, indicate whether it was yourself, your spouse, or your parents. Fill in the appropriate financial figures for each applicable party.

- Remember that all incomplete forms will be returned unprocessed. Make sure you review each section carefully.

- Sign and date the form, ensuring both the student and, if required, the parent have completed their parts. You are verifying that the information given is accurate.

- After filling out all relevant fields and signing the form, you can save your changes, download, print, or share the completed Taxable Scholarships And Grants Form as needed.

Complete your Taxable Scholarships And Grants Form online today to ensure timely processing of your financial aid.

Whether you need to report scholarships and grants on your taxes depends on how you used the funds. If the funds were used for qualified educational expenses, they might not be taxable. However, any amounts used for non-qualified expenses must be reported. To determine your reporting requirements, the Taxable Scholarships And Grants Form is essential for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.