Loading

Get Business Supplement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Supplement Form online

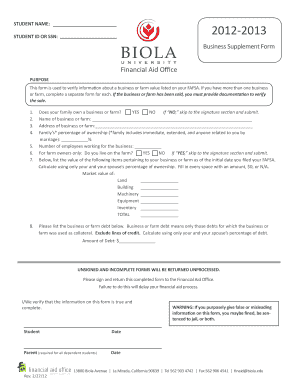

The Business Supplement Form is essential for verifying business or farm values listed on your FAFSA. This guide will provide you with clear instructions to complete this form online effectively.

Follow the steps to complete the Business Supplement Form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate whether your family owns a business or farm by selecting 'YES' or 'NO'. If you select 'NO', proceed directly to the signature section.

- If you answered 'YES', provide the name of the business or farm in the designated field.

- Enter the address of the business or farm in the corresponding field.

- Fill in the family’s percentage of ownership, which includes immediate and extended family members related by marriage.

- Input the total number of employees working for the business.

- For farm owners, indicate whether you live on the farm. If 'YES', you may continue to the signature section.

- List the market value of the land, building, machinery, equipment, and inventory, calculating according to your and your spouse's percentage of ownership.

- Provide the details of any debts associated with the business or farm, calculating based on your and your spouse's percentage of debt.

- Ensure all sections are completed accurately and sign within the signature section indicating that the information is true and complete.

- Once you have filled out the form, save your changes and consider downloading, printing, or sharing it as needed.

Complete your Business Supplement Form online today to ensure a smooth financial aid process.

To report business expenses effectively, you should use the Business Supplement Form, which allows you to break down your expenses in a clear manner. This form is crucial for categorizing your costs and ensuring you're not overlooking any potential deductions. Properly utilizing this form can enhance your overall tax strategy, potentially leading to significant savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.