Loading

Get Massachusetts Foreclosure Law Summary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Foreclosure Law Summary online

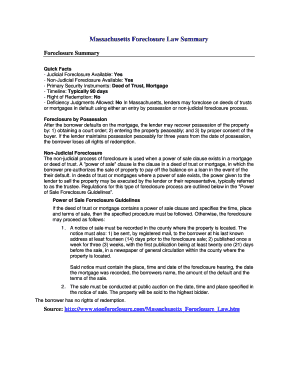

The Massachusetts Foreclosure Law Summary provides clarity regarding the legal aspects of foreclosure in the state. This guide aims to assist users in navigating the process of filling out this document online with ease and understanding.

Follow the steps to complete the Massachusetts Foreclosure Law Summary online.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Review the heading and ensure you understand the context of the Massachusetts Foreclosure Law. This section is crucial as it outlines the legal basis for the foreclosure actions you may be involved with.

- Fill out your personal information in the designated fields. This may include your name, contact information, and any relevant identification numbers. Ensure accuracy to prevent future complications.

- Navigate to the section pertaining to the details of the property involved in the foreclosure process. Include the address and any necessary descriptions to clearly identify the property.

- Complete the area that describes the type of foreclosure (judicial or non-judicial) applicable to your situation. Be sure to reference the definitions and procedures to select accurately.

- Identify and enter information regarding the lender or mortgagee involved in the foreclosure. This includes their name and contact details as required in the form.

- Summarize any information regarding prior communications or notifications related to the foreclosure. This will help in setting the context for any disputes or discussions.

- Review all entered information for accuracy and completeness. It’s important that all fields are filled out correctly to ensure that the document is valid.

- Once all information is complete, users can save changes, download the completed form, print it for records, or share it with relevant parties as necessary.

Ensure you complete your documents online for a smoother submission process.

Once a summary judgment is granted, the court may authorize the lender to move forward with the foreclosure process. This typically means the property can be sold to recover the outstanding debt. The Massachusetts Foreclosure Law Summary offers crucial information about this stage, indicating that borrowers still have options to negotiate with the lender or explore alternative resolutions before the property is sold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.