Loading

Get Tsp 10-u-6 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP 10-u-6 online

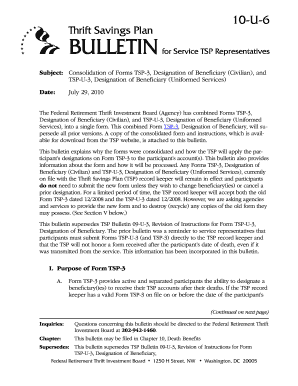

The TSP 10-u-6 form, officially known as Form TSP-3, is designed for federal civilian employees and members of the uniformed services to designate beneficiaries for their Thrift Savings Plan (TSP) accounts. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully fill out the TSP 10-u-6 form online.

- Press the ‘Get Form’ button to access the TSP 10-u-6 form and open it in your preferred online editor.

- In Section I, provide your participant information. Select whether you are filling it out for a civilian account or a uniformed services account. Enter your full name, date of birth, TSP account number, and daytime phone number.

- If you wish to cancel all previous beneficiary designations without adding new ones, check the cancellation box in Section II.

- Proceed to Section III and sign the form, ensuring that you have two witnesses sign it as well, confirming you signed in their presence.

- In Section IV, designate your primary beneficiaries. For each primary beneficiary, indicate their relationship to you, their name, and percentage share, totaling 100 percent. Include their addresses and tax identification numbers if available.

- If applicable, move to Section V to designate contingent beneficiaries who will receive benefits if primary beneficiaries are no longer living. Ensure their designated shares total 100 percent as well.

- Review each section of the form for accuracy and completeness, ensuring you have not altered any information. Make a copy for your records.

- Submit the completed form by mailing or faxing it to the Thrift Savings Plan at the designated address and fax number.

Complete your TSP 10-u-6 form online to ensure your beneficiary designations are up-to-date.

Yes, if you take a withdrawal from your TSP, you will receive a 1099-R form. This form details the amount distributed and indicates how much is taxable. Having this information is crucial for accurately addressing your tax obligations associated with TSP 10-u-6.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.