Get Scotiabank Declaration Of Beneficial Ownership In A Corporation Or Similar Entity 2008-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar Entity online

Filling out the Scotiabank Declaration of Beneficial Ownership is an essential step for ensuring compliance with regulatory requirements. This guide will provide you with a clear and comprehensive set of instructions to help you accurately complete the form online.

Follow the steps to complete the Declaration of Beneficial Ownership.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

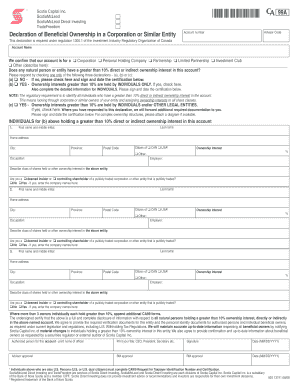

- Begin by entering your account number and advisor code at the top of the form. This information helps to identify your account within the Scotiabank system.

- Specify the account name and select from the provided options to indicate the type of entity you are declaring: Corporation, Personal Holding Company, Partnership, Limited Partnership, Investment Club, or Other (please describe).

- Respond to the ownership interest question regarding individuals or entities having greater than a 10% ownership interest in the account. Check the appropriate box: (a) No, (b) Yes - Individuals Only, or (c) Yes - Individuals and/or Other Legal Entities. Make sure to provide any required additional documentation if needed.

- If you selected option (b) or (c), fill out the details for each individual or legal entity holding greater than 10% ownership interest. Include their last name, first name, middle initial, home address, city, province, postal code, and citizenship.

- Document the ownership interest percentage for each individual listed. Additionally, provide their occupation and employer information, along with a description of the class of shares or ownership interest held.

- Indicate whether the individual is a deemed insider or controlling shareholder of a publicly traded corporation by checking the appropriate box and writing the company names if applicable.

- If there are more than three individuals holding greater than 10% in the entity, append additional forms as necessary using CA99 forms.

- Finalize the form by having an authorized person print their name, title, sign, and date the certification section at the bottom.

- Once all fields are complete, review the information for accuracy, then save your changes, download, print, or share the completed form as required.

Complete your documents online to ensure compliance and accuracy.

A beneficial owner of an entity can be anyone who directly or indirectly holds an interest in the company, exerting control or influence—this can include individuals, trusts, or other entities. Importantly, the Scotiabank Declaration of Beneficial Ownership in a Corporation or Similar Entity helps clarify the criteria used to identify these owners. This inclusion is essential for compliance with regulatory frameworks.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.