Get Nacm-national Bookstore Request For Bank Credit Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NACM-National Bookstore Request for Bank Credit Information online

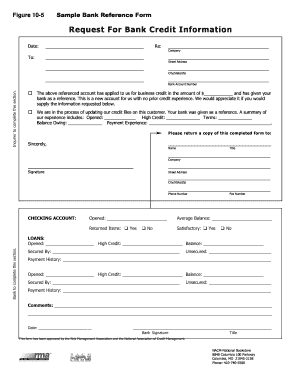

Completing the NACM-National Bookstore Request for Bank Credit Information is a vital step in obtaining relevant bank credit information for business purposes. This guide offers a clear, step-by-step approach to help users fill out the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Begin by entering the date at the top of the form. This helps establish the timeline for the request.

- In the 'Re' section, provide the name of the company that is seeking bank credit information.

- In the 'To' section, fill in the name of the bank that will be providing the credit information.

- Next, complete the street address, city, state, and zip code of the bank in the respective fields.

- For the section labeled 'Inquirer to complete this section,' enter the bank account number of the company applying for credit.

- Specify the amount of business credit requested in the provided field.

- If applicable, fill out the part regarding the customer's credit update, including the date opened, high credit, terms, balance owing, and payment experience.

- In the section for the person completing the form, enter their name, title, company, and add their signature.

- Provide the street address, city, state, zip code, and phone number of the person filling out the request.

- For the checking account section, the bank will fill out the details regarding the account's status, including opened date, average balance, returned items, and if the account is satisfactory.

- When it comes to loans, record the opened date, high credit, balance, as well as secured and unsecured information. Additionally, document the payment history.

- Lastly, make sure to add any comments the bank may have and include the date of completion. The bank must sign and include their title.

- After completing all sections, users can save changes, download, print, or share the form as needed.

Begin filling out the NACM-National Bookstore Request for Bank Credit Information online today for a seamless experience.

Related links form

Federal Reserve credit refers to the funds that the Federal Reserve makes available to the financial system. It ensures liquidity and supports the stability of the banking system. For businesses, grasping the concept of Federal Reserve credit can be vital, especially when preparing your NACM-National Bookstore Request for Bank Credit Information, as it can affect your overall credit status.

Fill NACM-National Bookstore Request for Bank Credit Information

Here you will find valuable tools for the credit professional, including links to training resources, online education, useful forms and timely publications. Request For Bank Credit Information. NACM Affiliates and FCIB, NACM's international association, provide comprehensive, up-to-date business credit information on companies throughout the world. 1. Define the term credit. 2. Describe the historical development of credit. 3. Credit Managers (NACM, formerly the National Association of Credit Men) and the. Credit Research Foundation (CRF). Among the many business groups lobbying for a more robust foreign trade was the National Association of Credit Men (NACM), established in 1896. This document covers the procedures and ethical considerations involved in credit investigations, emphasizing the importance of proper information gathering. Org or .

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.