Loading

Get Msdc Sba 504

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MSDC SBA 504 online

Filling out the MSDC SBA 504 form online can be a straightforward process if you follow the right steps. This guide will provide clear instructions to help you complete each section accurately and efficiently.

Follow the steps to complete your form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

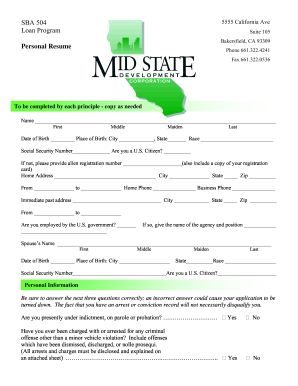

- Begin with the section for personal information. Fill out your first, middle, maiden, and last names as requested. Ensure accuracy to prevent delays in processing your application.

- Enter your date and place of birth, including the city and state. Provide your race and Social Security number as required. Indicate whether you are a U.S. citizen and, if applicable, include your alien registration number.

- Complete your home address, including city, state, and zip code. Include your home and business phone numbers. Then, provide your immediate past address with the same details.

- If you are employed by the U.S. government, specify the agency and your position. If you have a spouse, fill in their details including their name and date of birth.

- Answer the personal information questions precisely, noting especially the implications of any criminal history. Include any relevant details on a separate document if necessary.

- For military service, state the branch, dates of service, rank at discharge, and a brief job description.

- List your work experience chronologically. For each employment entry, include the company name, percentage of business owned, full address, dates of employment, title, and a brief description of duties.

- In the education section, provide the names and locations of institutions attended, dates, major studied, degree or certificate earned, and any pertinent comments.

- Review all entries for accuracy. Once you are satisfied with the information provided, you can save your changes, download the finished form, print it for your records, or share it as needed.

Take charge of your financial future by completing your MSDC SBA 504 form online today.

Completing an SBA financial statement requires accurate information about your business's assets, liabilities, income, and expenses. You should include all relevant financial documents, such as balance sheets and profit-loss statements, which provide a clear picture of your business's financial health. Using uslegalforms, you can access templates and resources to simplify this process, making it easier to prepare and submit your financial statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.