Loading

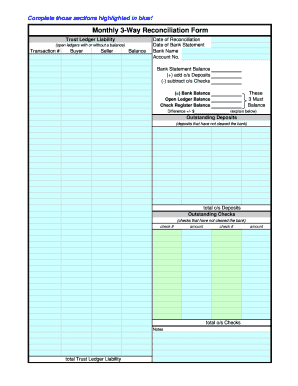

Get Monthly 3-way Reconciliation Form - Irec Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Monthly 3-Way Reconciliation Form - Irec Idaho online

The Monthly 3-Way Reconciliation Form - Irec Idaho is a vital tool for ensuring accurate financial records. Completing this form online can streamline your reconciliation process, making it easier to maintain transparency and accountability in financial transactions.

Follow the steps to successfully complete your Monthly 3-Way Reconciliation Form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the upper right corner of the form, input the ‘Date of Reconciliation’, which refers to today's date when the reconciliation is completed.

- Enter the ‘Date of Bank Statement’ as indicated on your bank statement, reflecting the ending date.

- Locate any deposits made post the closing date on the bank statement and list them under 'Outstanding Deposits'. The total will be automatically calculated and should be transferred to the balance box.

- Identify any checks that have not cleared the bank, including those issued in previous months that remain outstanding. Enter these under ‘Outstanding Checks’. The total will automatically appear in the balance box.

- Compile all pending (open) trust account ledger balances in the left-hand columns under 'Trust Liability', referencing the transaction number along with buyer/seller names. Include any relevant Trust Maintenance Funds ledger balances.

- Input the current balance from the check register into the 'Check Register Balance' line.

- Verify that the Bank Balance, Open Ledger Balance, and Check Register Balance are identical, indicating that the account is in 3-way balance.

- If discrepancies are noted, indicate the amount that is 'off' and investigate your records to determine the reason for the imbalance.

Complete and submit your Monthly 3-Way Reconciliation Form online to ensure accurate financial reporting.

Creating a reconciliation sheet starts with laying out the format clearly. Include sections for your beginning balance, deposits, withdrawals, and the ending balance. As you fill it out, match each entry against your bank statements, making adjustments as necessary. A well-organized sheet helps clarify your financial view.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.