Loading

Get H&r Block Form 307 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H&R Block Form 307 online

Filling out the H&R Block Form 307 online can be a convenient way to manage your IRA distribution requests. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the H&R Block Form 307 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

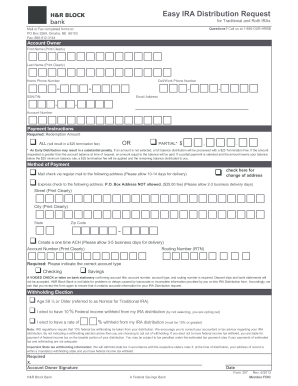

- Enter your personal information in the 'Account Owner' section. Clearly print your first name, last name, home phone number, cell/work phone number, Social Security Number (SSN), email address, and account number.

- In the 'Payment Instructions' section, select whether you want to redeem a specific amount or the entire balance. If you choose a partial distribution, specify the amount in dollars and cents.

- Choose the method of payment for your distribution. You can opt for a regular mail check, an express check (note the additional fee and conditions), or a one-time ACH transfer. Ensure you fill in the required address or bank information as needed.

- Indicate your withholding election if you are age 59 ½ or older. Select whether you wish to withhold 10% federal income tax or a specified rate. Review the implications of opting out.

- Sign and date the form in the 'Account Owner Signature' section to validate your request.

- Once you have completed all sections of the form, save your changes, and download or print the document for your records. You may then proceed to submit via mail or fax as instructed.

Start filling out your H&R Block Form 307 online today to manage your IRA distribution.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The amount you receive for the dependent care credit, such as $1200, often depends on your income and the number of eligible expenses. It's crucial to check your calculations against IRS guidelines and ensure you are using the correct forms, including the H&R Block Form 307. If you have questions, H&R Block can provide valuable insights during your tax preparation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.