Get You Must Complete This Bform/b If You Receive A Levy Notice For A Person That You Currently Employ

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the You Must Complete This Bform/b If You Receive A Levy Notice For A Person That You Currently Employ online

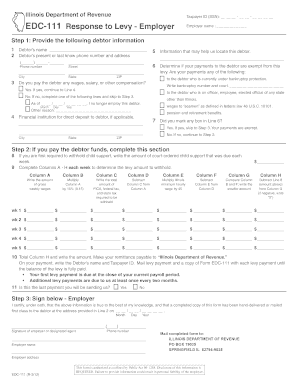

Completing the form You Must Complete This Bform/b is essential for employers who receive a levy notice regarding an employee. This guide provides clear and supportive instructions on filling out the form online to ensure compliance and accuracy.

Follow the steps to accurately complete the levy response form.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin by providing the debtor's information, including their full name, current or last known phone number, and address. Make sure to fill in all required fields carefully.

- Indicate whether you pay the debtor any wages or compensation. If you answer 'Yes', proceed to complete Line 4.

- Assess if the payments to the debtor are exempt from the levy by answering the relevant questions in Line 6. If you qualify for an exemption, skip to Step 6.

- Complete Step 2 only if you pay funds to the debtor. Write the weekly amount of court-ordered child support, if applicable.

- Fill out Columns A through H for each week of salary paid. This includes calculating and documenting gross weekly wages, deductions, and disposable earnings.

- Total Column H and note the amount due for payment, ensuring to include the debtor's name and taxpayer ID on the remittance.

- Confirm whether this is the last payment you will send. If so, indicate this clearly.

- Sign the document as the employer or designated agent, providing your contact number and mailing address.

- Finally, send the completed form and the payment to the Illinois Department of Revenue at the designated address, while also maintaining copies for your records.

Complete the necessary documents online now for a smooth and compliant response to the levy notice.

A levy occurs when a creditor seizes a debtor's property to satisfy a financial obligation. For instance, if you receive a levy notice related to an employee's unpaid taxes, the creditor may take a portion of their wages directly from your payroll. In this situation, you must complete this Bform if you receive a levy notice for a person that you currently employ. By taking the right steps, you can ensure that you handle the levy properly and protect both your interests and your employee's rights.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.