Loading

Get Ny It-241 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-241 online

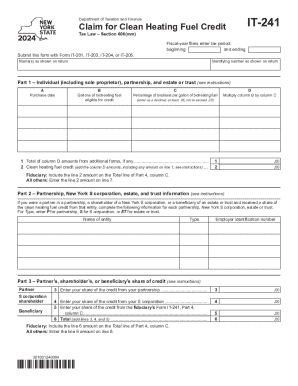

This guide provides essential information on how to fill out the NY IT-241 form for claiming the clean heating fuel credit. By following the steps outlined below, users can navigate the online submission process with confidence.

Follow the steps to successfully complete the NY IT-241 online.

- Click ‘Get Form’ button to obtain the document and open it in the online editor.

- Begin by entering your name(s) as shown on your tax return in the designated field.

- Provide your identifying number, which should match the number shown on your return.

- In Part 1, fill in the purchase date of the bioheating fuel, followed by the gallons eligible for credit.

- Enter the percentage of biodiesel per gallon of bioheating fuel you used, ensuring it is between .06 and .20.

- Calculate the total of column D amounts from any additional forms, if applicable, and report it in line 1.

- Sum the column D amounts, including any amount entered in line 1, to determine your clean heating fuel credit for line 2.

- Complete Part 2 by filling in the information for partnerships, corporations, estates, or trusts that provided you with credit.

- In Part 3, enter your share of credits from partnerships, S corporations, or fiduciaries in the appropriate lines.

- Proceed to Part 4 to enter the beneficiary's name and share of clean heating fuel credit.

- Calculate the total clean heating fuel credit in Part 5, adding the relevant lines to determine your final credit amount.

- Once you have completed the form, you can save changes, download, print, or share the completed document as needed.

Complete your NY IT-241 online today to claim your clean heating fuel credit.

The NYC PTET is imposed on the NYC PTE taxable income of an electing entity. Generally, the NYC PTE taxable income includes all income, gain, loss, or deduction of an electing entity that flows through to a direct partner, member, or shareholder for New York City personal income tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.