Loading

Get Sc8857

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc8857 online

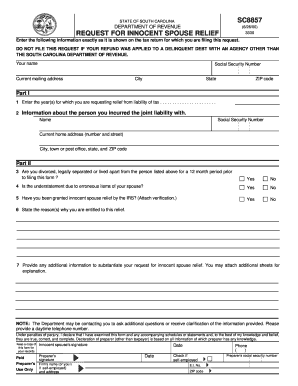

This guide provides clear instructions on how to fill out the Sc8857 form, formally known as the request for innocent spouse relief. Designed to assist individuals who are navigating the filing process online, this comprehensive overview will ensure you complete the form accurately and efficiently.

Follow the steps to complete your Sc8857 form online.

- Click the ‘Get Form’ button to obtain the Sc8857 form and open it in the designated editor.

- Enter your name as it appears on the tax return for which you are requesting relief. Ensure that you also provide your Social Security Number.

- In Part I, specify the year or years for which you are seeking relief from tax liability.

- In Part II, answer questions regarding your marital status and the nature of the tax liability, indicating if you have been divorced or legally separated.

- State the reasons you believe you are entitled to innocent spouse relief and provide any additional supporting information as necessary.

- Ensure to include a daytime telephone number for further contact if required.

- Complete any additional necessary fields, including preparer's information if applicable. Once finalized, save your changes, download the form, and choose to print or share it as needed.

Complete your Sc8857 form online today to request innocent spouse relief.

Form 8379 can be e-filed. An innocent spouse (Form 8857, Request for Innocent Spouse Relief) is asking the IRS not to hold him or her liable for tax resulting from actions of the other spouse in a joint return. Form 8857 is not transmitted with an e-filed return, but must be paper-filed separately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.