Loading

Get Pa Form Pa-40 Es (i) 2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Form PA-40 ES (I) online

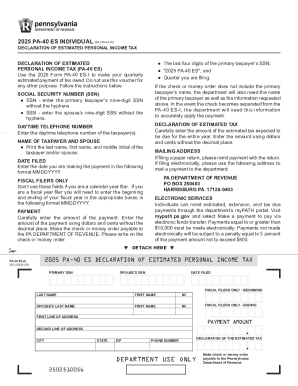

Filling out the PA Form PA-40 ES (I) online can streamline your estimated personal income tax payment process. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the PA Form PA-40 ES (I) online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the primary taxpayer’s nine-digit Social Security number (SSN) without hyphens in the designated field.

- Input the spouse’s nine-digit SSN without hyphens if applicable.

- Provide the daytime telephone number of the taxpayer(s) in the specified section.

- Print the last name, first name, and middle initial of the taxpayer and/or spouse in the appropriate areas.

- Enter the date you are making the payment using the format MMDDYYYY.

- If you are a fiscal year filer, enter the beginning and ending dates of your fiscal year in the corresponding fields in the format MMDDYYYY.

- Carefully enter the payment amount using dollars and cents without the decimal place in the payment section.

- Make the check or money order payable to the Pennsylvania Department of Revenue, ensuring to write the last four digits of the primary taxpayer’s SSN, '2025 PA-40 ES,' and the quarter you are filing on the payment.

- Enter the total estimated tax expected to be due for the entire year in the declaration of estimated tax section.

- If submitting by mail, use the provided mailing address for the Pennsylvania Department of Revenue to send your payment.

- Once all fields are completed, review the information for accuracy. You may then save changes, download the form, print it, or share it as needed.

Complete your PA Form PA-40 ES (I) online today to ensure your estimated payments are filed accurately and on time.

Related links form

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.