Loading

Get Irs 8892 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8892 online

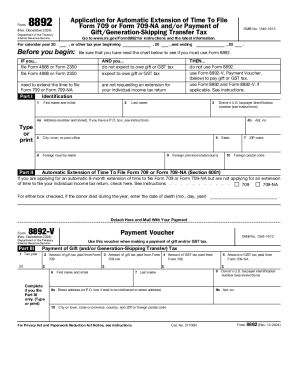

This guide provides a comprehensive and user-friendly approach to filling out the IRS Form 8892 online. Designed for individuals seeking an automatic extension of time to file Form 709 or Form 709-NA, this guide offers clear instructions on each component of the form.

Follow the steps to complete the IRS 8892 form online

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- Begin by entering your identification details: First name and initial, last name, and your U.S. taxpayer identification number in the respective fields.

- Provide your address, including the street number and name (Note: If using a P.O. box, refer to the instructions). Include your city, state, and ZIP code in the appropriate fields.

- Indicate whether you are applying for an automatic six-month extension of time to file Form 709 or Form 709-NA by checking the corresponding box.

- If applicable, enter the date of death of the donor if they died during the tax year.

- Complete Part III by providing details on any gift and generation-skipping transfer tax you have paid. Ensure you fill in the amounts as required based on your specific circumstances.

- Once you have filled out all necessary sections, review your entries for accuracy.

- Finalize your process by saving the changes made to the form. You can also download, print, or share the form as needed.

Start filling out your IRS 8892 form online today for a hassle-free experience!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.