Loading

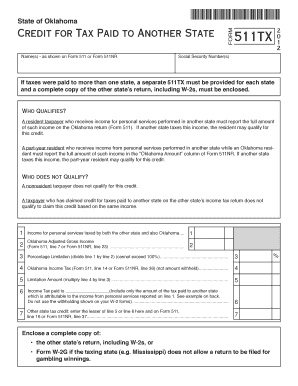

Get State Of Oklahoma Name(s) - As Shown On Form 511 Or Form 511nr Social Security Number(s) If Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the State Of Oklahoma Name(s) - As Shown On Form 511 Or Form 511NR Social Security Number(s) If Taxes online

Filling out the State Of Oklahoma Name(s) - As Shown On Form 511 Or Form 511NR Social Security Number(s) If Taxes online is a crucial step for individuals who have paid income taxes to another state. This guide aims to provide clear and detailed instructions to ensure accuracy in completing the form.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name(s) as they appear on Form 511 or Form 511NR. Make sure to double-check for spelling and formatting to avoid any discrepancies.

- Input your Social Security Number(s) in the designated field. This information is necessary for linking your tax records accurately.

- If you have received income for personal services performed in another state, fill in the taxable amount in the Income for personal services taxed by both the other state and also Oklahoma section.

- Complete the Oklahoma Adjusted Gross Income line by referencing the corresponding line from Form 511 or Form 511NR.

- Calculate the percentage limitation, which is the amount reported on line 1 divided by the amount on line 2. Ensure that this percentage does not exceed 100%.

- Enter the Oklahoma Income Tax that corresponds to your situation. This should not be the amount withheld, but rather the calculated tax based on your income.

- Compute the limitation amount by multiplying the Oklahoma Income Tax by the percentage limitation determined in the previous step.

- Provide the total income tax paid to another state that is directly attributable to the income reported in line 1.

- Enter the lesser of the limitation amount from line 5 or the tax paid to the other state from line 6 in the appropriate field.

- Remember to enclose a complete copy of the other state’s return, including W-2 forms, or Form W-2G if applicable, with your submission.

- Once completed, save any changes and consider downloading or printing the form for your records. You can also share it if necessary.

Complete your tax documents online today for a seamless filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.