Loading

Get Due Date Fein Ssn B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Due Date FEIN SSN B online

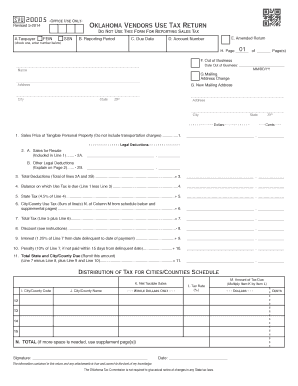

Filling out the Due Date FEIN SSN B form online can seem complicated, but with a clear understanding of each section, it is manageable. This guide is designed to provide step-by-step instructions to ensure you complete the form accurately and meet all requirements.

Follow the steps to complete the Due Date FEIN SSN B form effectively.

- Press the ‘Get Form’ button to obtain the Due Date FEIN SSN B and open it in your preferred editor.

- Review the preprinted information in Section A to ensure your taxpayer identification number is correct. If it is incorrect, reach out to the Oklahoma Tax Commission’s Taxpayer Assistance Division.

- In Section B, input the reporting period by entering the month(s) and year for the sales being reported.

- In Section C, enter the due date for the form submission.

- If applicable, check the box in Section E to indicate that this is an amended return.

- If this is your final use tax return, check Section F and provide the date you went out of business.

- Complete Section G if there has been a change in your mailing address, including providing the new address.

- For item 1, fill in the total sales price of tangible personal property, excluding transportation charges.

- In item 2A, record any sales for resale as well as item 2B for other legal deductions, explaining those deductions if necessary.

- Calculate total deductions in item 3 by summing items 2A and 2B.

- Determine your balance on which use tax is due in item 4 by subtracting item 3 from item 1.

- Calculate the state tax for item 5, which is 4.5% of the amount in item 4.

- In item 6, summarize the city or county use tax.

- Total the taxes in item 7 by adding items 5 and 6.

- If eligible, apply the discount in item 8 for timely submissions.

- Calculate any interest due in item 9 if applicable.

- In item 10, include any penalties that may apply.

- Calculate the total state and city/county due in item 11 by following the formula provided.

- Finally, sign and date the form before mailing it with your payment to the Oklahoma Tax Commission.

Complete your Due Date FEIN SSN B form online today to ensure timely and accurate submission!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.