Loading

Get Umsl Application For Non-resident Tax Offset Credit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UMSL Application for Non-Resident Tax Offset Credit online

Filling out the UMSL Application for Non-Resident Tax Offset Credit online can seem daunting. This guide provides you with clear, step-by-step instructions to help you through the process, ensuring you have the necessary information and documentation to complete your application successfully.

Follow the steps to complete the application form effectively.

- Press the ‘Get Form’ button to access the application form and open it in the designated online editor.

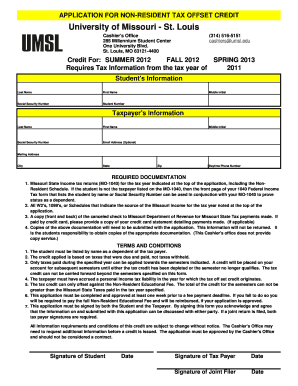

- Begin by entering your personal information in the 'Student's Information' section. This includes your last name, first name, middle initial, Social Security number, and student number.

- Next, fill out the 'Taxpayer's Information' section with the required details: last name, first name, middle initial, Social Security number, email address (optional), mailing address, city, state, zip code, and daytime phone number.

- Review the list of required documentation carefully. Ensure you have copies of the Missouri State income tax returns for the specified tax year, all relevant W-2s, 1099s, or schedules showing your Missouri income, and a copy of the canceled check for state tax payments or credit card statements if applicable.

- Attach copies of the necessary documentation as outlined. Remember that these copies will not be returned, so ensure you retain your originals.

- Read through the terms and conditions to make sure you understand the eligibility criteria and requirements for the tax credit.

- Obtain the required signatures from both the student and the taxpayer at the bottom of the application form. If a joint return was filed, ensure both taxpayer signatures are included.

- Once you have filled out the form completely and gathered the necessary documentation, save your changes and prepare to download, print, or share the application as needed.

Complete your UMSL Application for Non-Resident Tax Offset Credit online today to ensure you meet the application deadlines.

Yes, you can use a foreign tax credit to offset U.S. income taxes on income that was also taxed by a foreign government. This can help prevent double taxation, allowing you to keep more of your earnings. Consider consulting resources like uslegalforms to get assistance in filing the necessary forms for claiming this credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.