Loading

Get Schedule Ii - Nebraska Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule II - Nebraska Department Of Revenue online

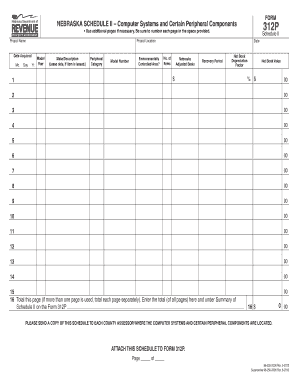

Filling out the Schedule II form for the Nebraska Department of Revenue is an essential step in reporting computer systems and certain peripheral components for tax purposes. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your Schedule II form.

- Click ‘Get Form’ button to obtain the Schedule II form and open it in the editor.

- Begin by entering the project name on the form. This should reflect the name associated with the computer systems and equipment you are reporting.

- Next, fill in the project location, specifying the address where the computer systems are housed.

- In the 'Date Acquired' field, input the date that you acquired each item. For leased items, use the date the lessor acquired the item.

- Provide the model year and model of each item in the designated fields.

- In the 'Make/Description' section, enter the make and a brief description of the item. If applicable, include the lease date.

- Select the appropriate 'Peripheral Category' from the given options based on the type of equipment.

- Indicate whether the item is located in an environmentally controlled area by marking 'YES' or 'NO'.

- Enter the number of identical items acquired on the same date, with the same model year and description.

- Calculate the Nebraska adjusted basis by adding the total purchase price, including costs for delivery, installation, taxes, and fees, and input this amount in whole dollars.

- Determine and enter the recovery period for the item based on the Nebraska tax regulations.

- Input the net book depreciation factor corresponding to the recovery period and the acquisition year.

- Calculate the net book value by multiplying the Nebraska adjusted basis by the depreciation factor and enter this amount.

- If using multiple pages, make sure to total the net book values on each page and record these totals on line 16.

- Finally, attach this Schedule II to Form 312P and ensure a copy is sent to each county assessor where the equipment is located.

Complete your Schedule II form online today to ensure timely and accurate reporting for tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.