Loading

Get Fill-in Form 1065n With Schedules I, Ii, And Iii - Nebraska ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

*How to fill out the Fill-in Form 1065N With Schedules I, II, And III - Nebraska online*

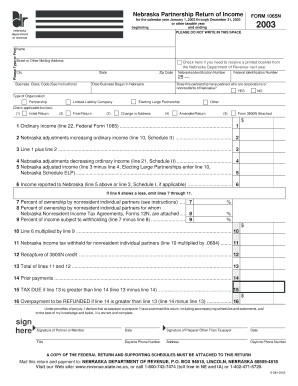

Filling out the Fill-in Form 1065N With Schedules I, II, and III is essential for partnerships operating in Nebraska. This guide provides clear, step-by-step instructions to help users of all experience levels complete the form online.

Follow the steps to fill out the form accurately online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Start by entering the name of the partnership and the mailing address in the provided fields. Ensure you provide a complete address including city, state, and zip code.

- Indicate the Nebraska Identification Number and the Federal Identification Number. This information is crucial for tax purposes.

- Select the type of organization by checking the appropriate box. Options include Partnership, Limited Liability Company, Electing Large Partnership, or Other.

- Indicate if this is the initial return, final return, a change of address, an amended return, or if Form 3800N is attached by checking the relevant box.

- For the income section, enter the figures for ordinary income, Nebraska adjustments increasing and decreasing that income as indicated on Form 1065N and applicable schedules.

- Complete the Nebraska Schedule I for apportionment of income if necessary, including entering the adjusted income and apportionment factors.

- Fill out the Nebraska Schedule II for adjustments to ordinary income with detailed entries for increasing and decreasing adjustments, ensuring to attach any relevant schedules.

- If applicable, complete the Nebraska Schedule III for nonresident partners or corporate partners, providing all necessary details and calculations.

- Review all entries for accuracy, then save changes before downloading or printing the form. Be sure to attach all required documents and schedules.

Complete your forms online to ensure compliance with Nebraska state tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.